- NZD/USD reversed sharply from session lows at 0.7112 as Kiwi remained supported from RBNZ Governor Wheeler’s overnight comments.

- Risks skewed to the downside amid bearish NZ fundamentals and Fed/RBNZ monetary policy divergence.

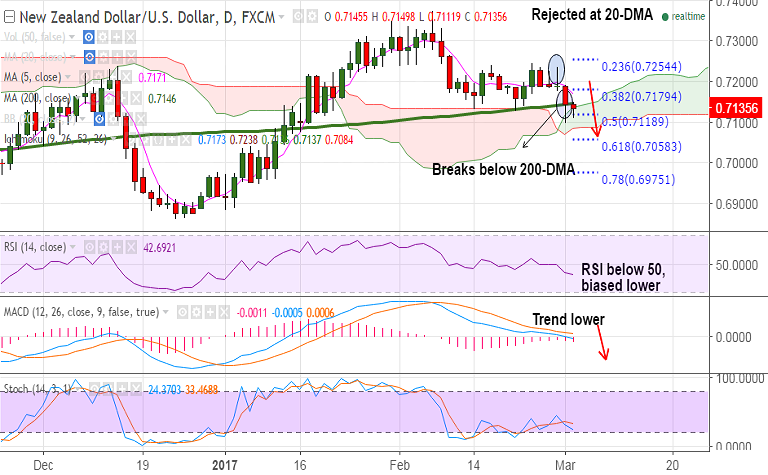

- Upside in the pair capped below 200-DMA at 0.7146. Bearish invalidation only on close above.

- Technical studies are biased lower, we see scope for test of 0.7058 (61.8% Fib retrace of 0.6862 to 0.7375 rally).

Support levels - 0.7119 (50% Fib), 0.7087 (cloud base), 0.7058 (61.8% Fib)

Resistance levels - 0.7146 (200-DMA), 0.7171 (5-DMA), 0.7208 (20-DMA)

TIME TREND INDEX OB/OS INDEX

1H Neutral Neutral

4H Neutral Neutral

1D Bearish Neutral

1W Bearish Neutral

Recommendation: Good to go short on rallies around 0.7145/50, SL: 0.7210, TP: 0.7120/ 0.7090/ 0.7060

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -18.6121(Neutral), while Hourly USD Spot Index was at 101.723 (Highly bullish) at 0510 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.