- Strong US non-farm payrolls figure and the resulting monetary policy divergence weighing on NZD/USD.

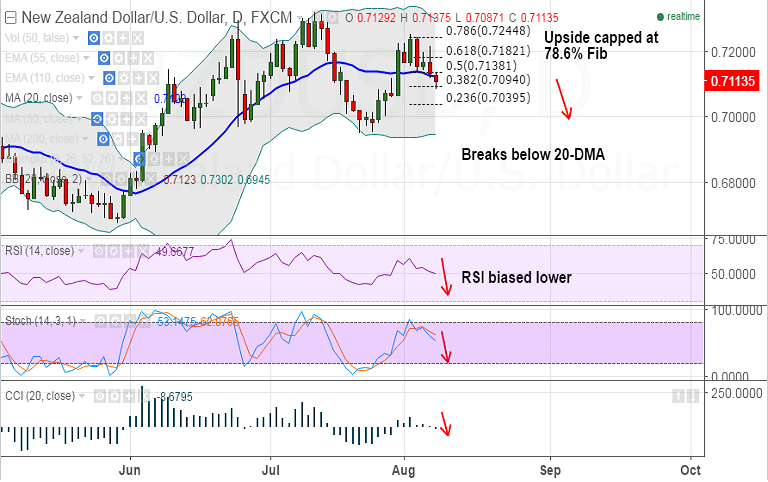

- The pair has broken below 20-DMA support at 0.7123, intraday bias is lower.

- Stochs and RSI are biased south, we see scope for test of 23.6% Fib at 0.7040.

- RBNZ meets on Aug 11th to decide monetary policy and is widely expected to cut rates.

- Downside finds strong support at 0.7094 (38.2% Fib), 0.7062 (28 July low) and then 0.7040 (23.6% Fib).

- Resistance on the flipside is seen at 0.7123 (20-DMA), 0.7138 (50% Fib) and then 0.7153 (18 July high).

Recommendation: Good to sell on rallies around 0.7120/30, SL: 0.7085, TP: 0.7060/ 0.7040