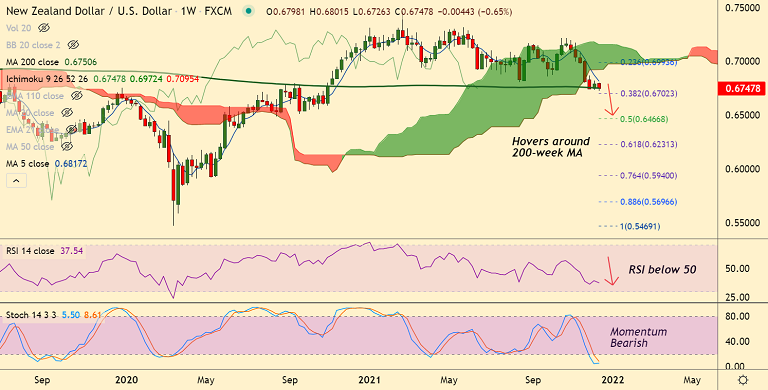

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

- NZD/USD was trading 0.09% higher on the day at 0.6747 at around 08:15 GMT

- Price action is below major moving averages and 5-DMA is biased lower

- Momentum is strongly bearish, Stochs and RSI are in oversold territory

- Volatility is high as evidenced by wide spread Bollinger bands

- GMMA indicator shows major and minor trend are strongly bearish

Support levels - 0.6750 (200-week MA), 0.6702 (38.2% Fib)

Resistance levels - 0.6766 (5-DMA), 0.6772 (200H MA)

Summary: NZD/USD has paused a 4-day downside streak and hovers around 200-week MA. Caution prevails ahead of key FOMC meeting. Technical bias is bearish, watch out for decisive break below 200-week MA for further downside.