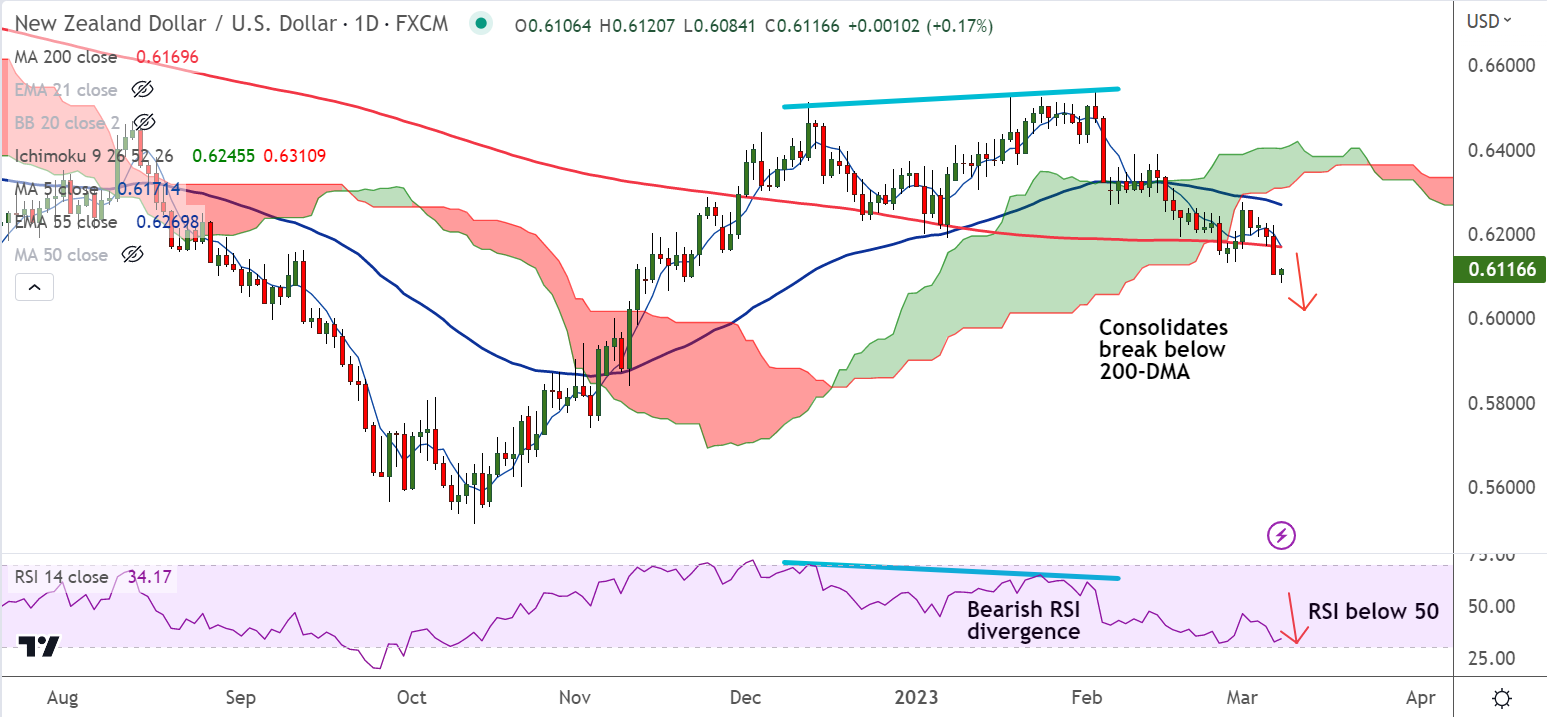

Chart - Courtesy Trading View

Spot Analysis:

NZD/USD was trading 0.11% higher on the day at 0.6111 at around 08:05 GMT.

Previous Week's High/ Low: 0.6275/ 0.6131

Previous Session's High/ Low: 0.6221/ 0.6103

Fundamental Overview:

US dollar buoyed after Federal Reserve Chair Jerome Powell warned that interest rates could go higher than expected.

Powell said that the US central bank would be prepared to move faster and that interest rates could peak higher if data warranted.

Further, China's mixed trade data and a warning on a potential escalation in Sino-U.S. tensions from China's foreign minister soured risk appetite, denting antipodeans.

While the country posted a record trade surplus in the January-February period, a sharp drop in imports raised concerns over a sluggish recovery in local demand.

Focus now on the Fed's Beige Book due later on Wednesday and a reading on nonfarm payrolls due on Friday for further impetus.

Domestically, the Reserve Bank of New Zealand (RBNZ) raised interest rates by 50 basis points in a widely anticipated move at its February meeting.

However, the central bank maintained its projection of a 5.5% peak, a hawkish sign for markets.

Technical Analysis:

- NZD/USD slumped lower to close below 200-DMA on Tuesday's trade

- GMMA indicator shows major and minor trend are bearish

- Momentum is bearish, volatility is high and rising

- MACD and ADX support weakness in the pair

Major Support and Resistance Levels:

Support - 0.5920 (Lower W BB), Resistance - 0.6169 (200-DMA)

Summary: NZD/USD trades with a bearish bias. Recovery attempts lack traction. Further downside on cards. Bearish invalidation only above 200-DMA.