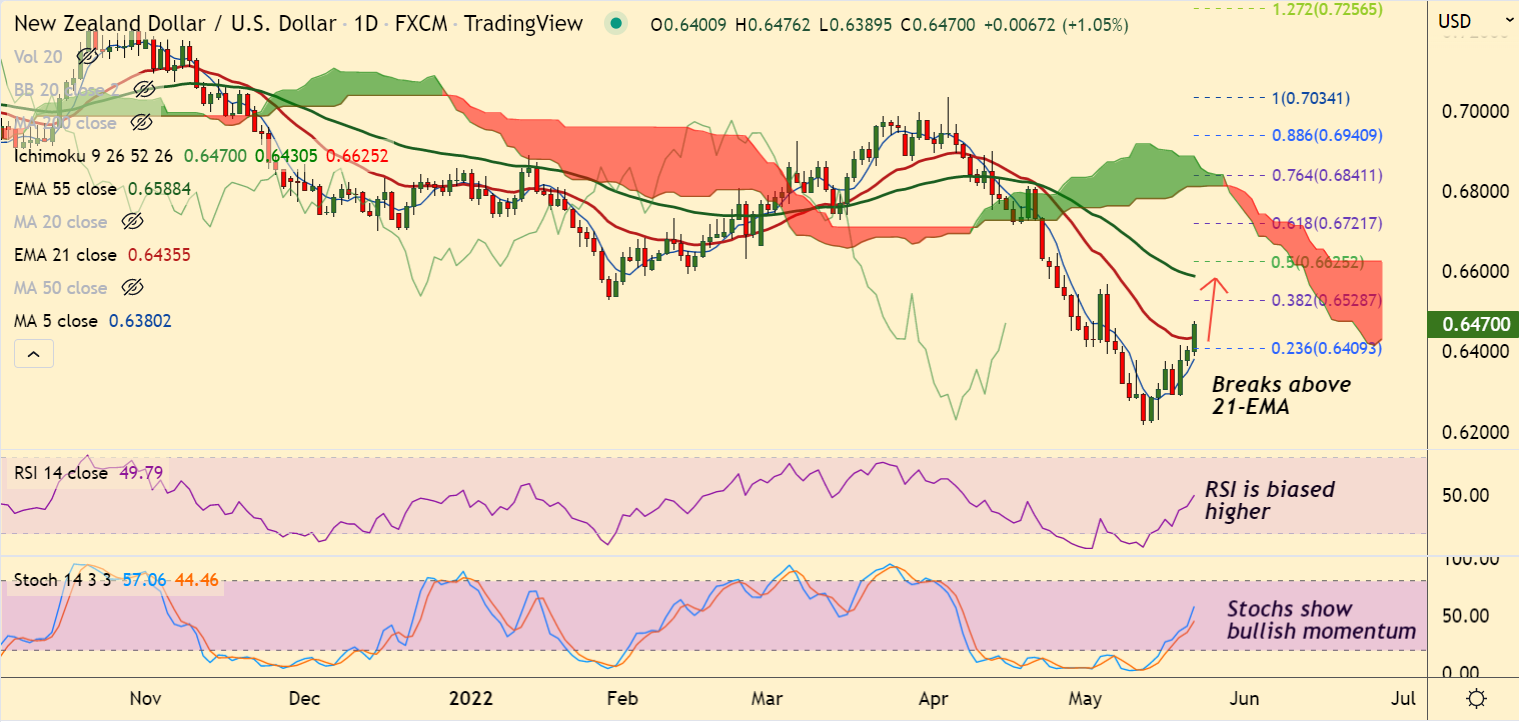

Chart - Courtesy Trading View

Technical Analysis: Bias Bullish

- NZD/USD was trading 1.00% higher on the day at 0.6466 at around 06:35 GMT

- Price action has broken above 21-EMA, the pair trades above 200H MA

- Momentum studies are bullish, Stochs and RSI are sharply higher

- MACD confirms bullish crossover on signal line, ADX supports upside

- 5-DMA is on verge of bullish crossover on 20-DMA, 5-DMA is biased North

- GMMA indicator shows bullish shift on the intraday charts

Support levels - 0.6435 (21-EMA), 0.6380 (5-DMA)

Resistance levels - 0.6528 (38.2% Fib), 0.6588 (55-EMA)

Summary: NZD/USD trades with a bullish bias. Scope for test of 38.2% Fib at 0.6528 ahead of 55-EMA at 0.6588.