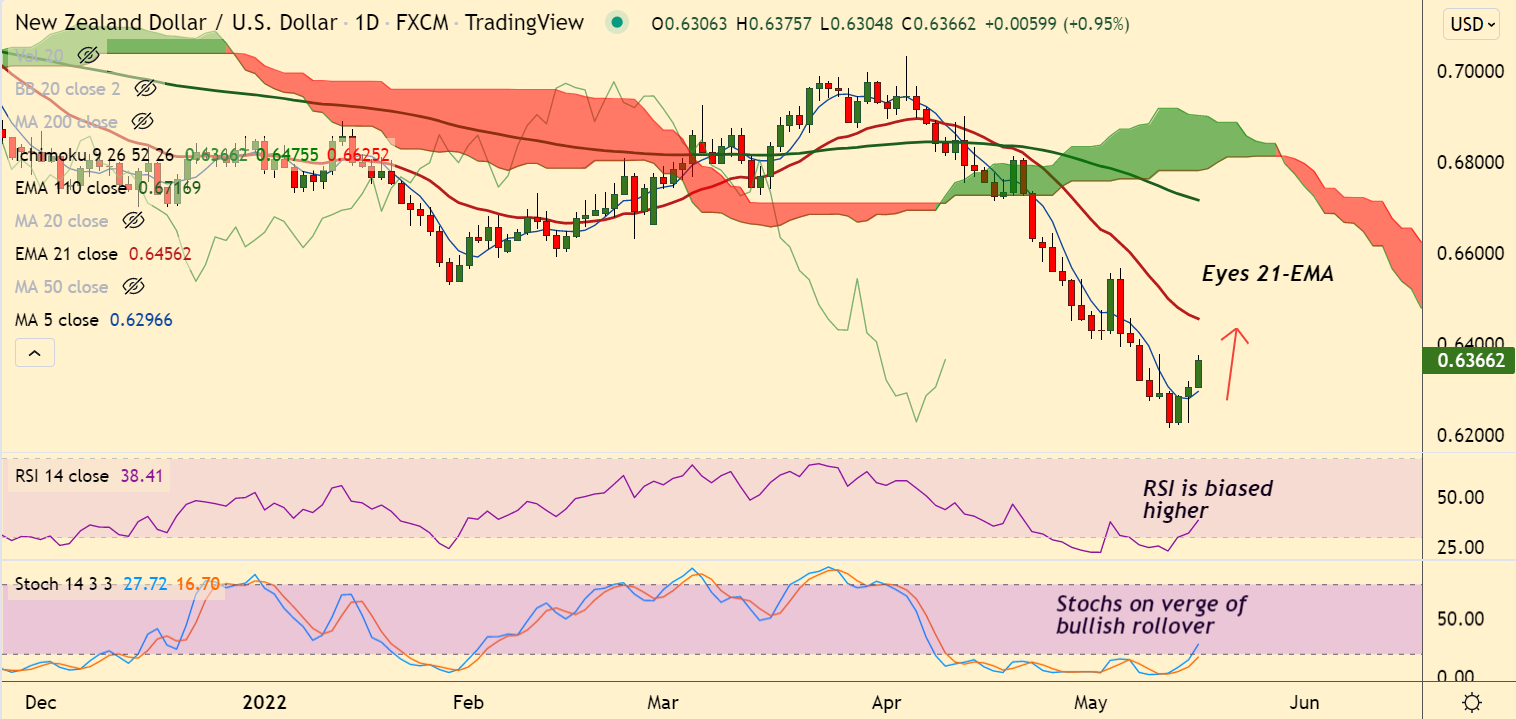

Chart - Courtesy Trading View

NZD/USD was trading 1.07% higher on the day at 0.6373 at around 11:55 GMT, extending gains for the 3rd straight session.

US dollar stays on the back foot despite firmer yields, risk-on mood weighs on greenback.

Also, DXY is trading lackluster after NY Empire State Manufacturing Index for May printed at -11.6 versus +15.5 expected.

On the data front, focus remains on US Retail Sales for April which is forecast to rise 0.7% versus 0.5% prior.

Technical bias for the pair is turning bullish after price action broke above 200H MA.

5-DMA has turned and Stochs and RSI are on verge of bullish rollover from oversold levels.

MACD is on verge of bullish crossover on signal line. Chikou span is biased higher.

Support levels - 0.63, 0.6296 (5-DMA), 0.6151 (Lower BB)

Resistance levels - 0.64, 0.6456 (21-EMA), 0.6620 (55-EMA)

Summary: NZD/USD technical bias is turning slightly bullish. Scope for test of 21-EMA at 0.6456.