The US fundamentals to outperform Kiwis that likely to cushion USD: Although NZDUSD has been gaining from last two-three weeks on account of dairy auction data ahead and healthy Kiwis economy, however, we foresee more bearish rout that is very much on cards during Christmas. The US economy bounce-back from H1’16 slowdown should put Fed back in motion. Additionally, Donald Trump's election as president has boosted the dollar more than any previous vote, given the myriad uncertainties his Administration brings to fiscal, monetary, and trade policy. If Trump’s policies validate the 2017 Fed dots, and 5% cumulative if the2018 dots start to look realistic.

Since the US real rates would likely to struggle to rise much as the Fed tightens. In the mid1980s, real rates were almost 10%. Pairwise performance should become much more differentiated by Q1/Q2 assuming trade conflict emerges early in the Administration. EUR, JPY, & CHF should outperform EM and commodity FX, and can rise outright vs USD despite Fed hikes. Thus,DXY could peak before the trade-weighted dollar does.

OTC Updates & the hedging strategy:

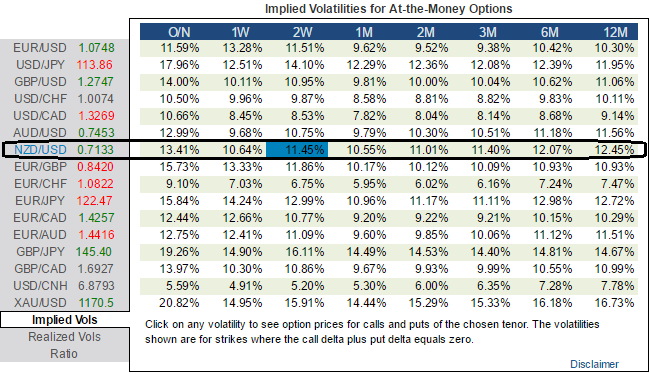

ATM IVs of this pair of 1w-1m expiries are hovering in between 10.64% to 10.55% and 2w IVs to spike above 11.45% that encompasses most significant news of Federal Reserve of US to announce its monetary policy in this December, analysts expect hikes in funds rates, while the RBNZ may hold in short un but would keep door open for further cuts in the months to come. Most importantly, you could also find positively skewed IVs in 1m tenors that signify the bears’ hedging interests for downside risks ahead of the fundamental news hovering around this currency pair.

If IV is in higher side amid bearish trend, then it would imply that the market ponders over the price has more potential for large downside movements.

Contemplating all these underlying factors, to arrest these downside risks we advocate initiating longs in 2m 2 lots of ATM +0.52 delta call options, simultaneously, 1m ATM -0.49 delta put option at net debit.

Rationale: Further dollar rally into December FOMC, the US dollar index rose to a fresh 14-year high early London but then retraced to be unchanged on the day.

Risk/return profile: No Fed cut and continued pro-carry macro environment, the key risks to the trade are that the RBNZ does not cut rates in November, the Fed does not hike by December, and the pro-carry global macro environment persists. The divergent policy expectations on the RBNZ and Fed are crucial for the trade to work.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures