- NZD/JPY has shown a decisive close above 200-DMA at 80.06 on Wednesday's trade, further upside on cards.

- Price action was rejected at lows on the day, the pair has held above 5-DMA at 80.16.

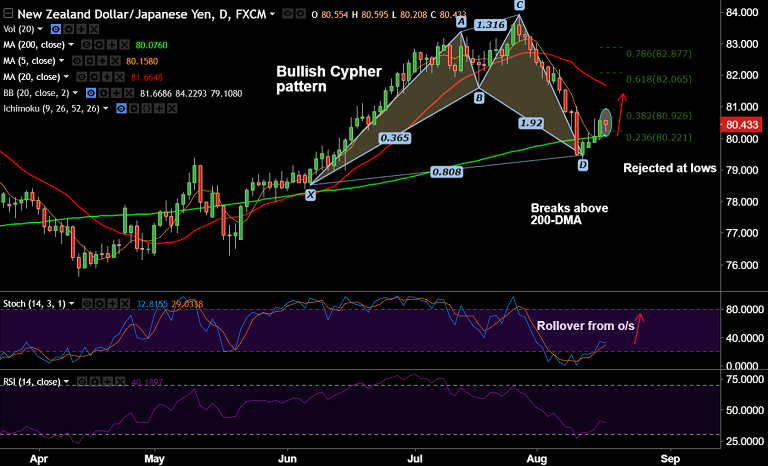

- The 'Bullish Cypher' pattern formed on daily charts keeps scope for upside.

- Technical studies have turned bullish, Stochs have shown a rollover from oversold levels.

- Weekly 20-DMA is strong support at 79.67, we see weakness only on break below.

- The pair failed to close below weekly 20-SMA in the previous week and is holding above in this week's trade.

Support levels: 80.15 (5-DMA), 80.07 (200-DMA), 79.71 (cloud base), 79.67 (weekly 20-SMA)

Resistance levels: 80.60 (50-DMA & Aug 15 high), 80.92 (38.2% Fib retrace of 83.910 to 79.081 fall), 81, 81.66 (20-DMA)

Call update: We had advised a long in our previous call (http://www.econotimes.com/FxWirePro-NZD-JPY-forms-Bullish-Cypher-pattern-good-to-go-long-on-close-above-200-DMA-at-8005-855033).

Recommendation: Bias higher, stay long.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.