We continue to view the risks to the NZD outlook as being to the downside in long run, but do not see an imminent catalyst, particularly with local data still robust.

That might well set off the next raft of unease as tensions between the real economy and financial markets flare.

Since, we could foresee risk bias on both sides in NZDJPY, as the long term downtrend seems intact and short term trend is just puzzling.

Well, technically although this pair has tested minor supports at 74.190 levels and showing considerable price bounces, but bearish pressures would be seen again at 76.951.

The RBNZ’s monetary policy season is also nearing, scheduled on 27th of this month that may bring in surprising packages but it also hinted the easing cycle may be over and that turned what ordinarily would be a currency negative event.

Despite RBNZ surprises cut of 25 bps previously, the strength is considerable that offers FX rates of this pair now at 75.961 and bids at 74.190 levels. Hence, at this baffling circumstance we’ve devised suitable option strategies to both for long term hedging and short term speculation during higher IVs.

Hedging Framework:

Spread ratio: (Long 1: Long 1)

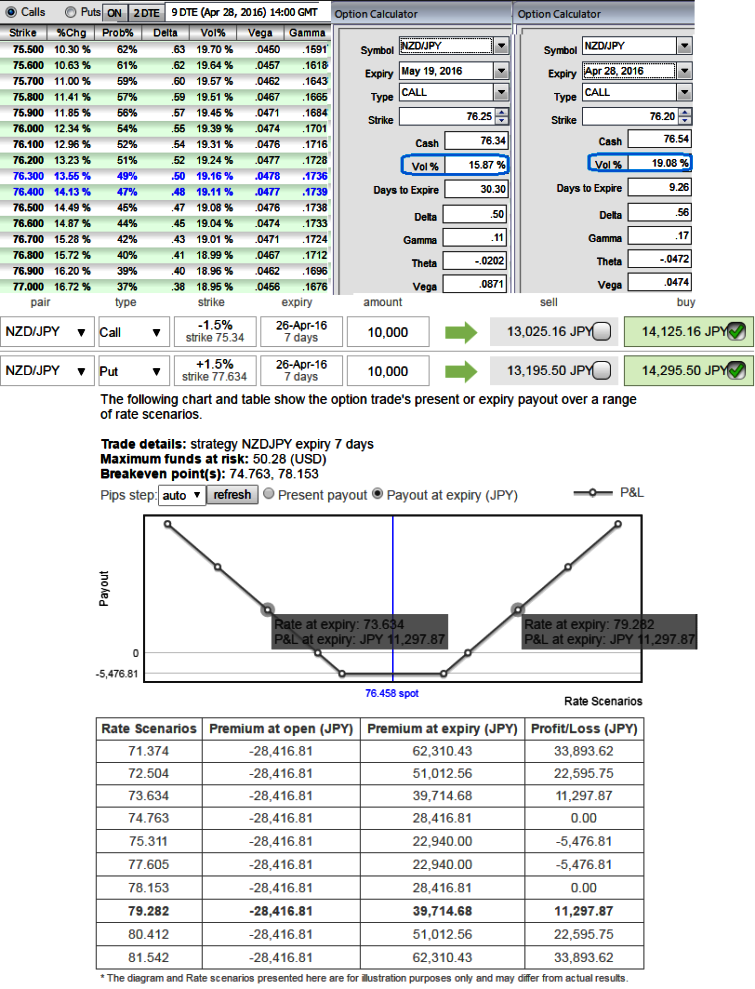

The implied volatility of 1M NZD/JPY ATM call options are at 15.87%.

Execution: Go long in NZD/JPY 1M (1.5%) in the money +0.66 delta calls, simultaneously go long in 1M (1.5%) in the money -0.65 delta puts.

Huge returns for this strategy is achievable when the underlying spot FX price creates a very strong move on either direction at expiration.

The move in the underlying spot FX price must be strong enough such that either the long call or the long put rise enough in value to offset the loss incurred by the other option expiring worthless.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed