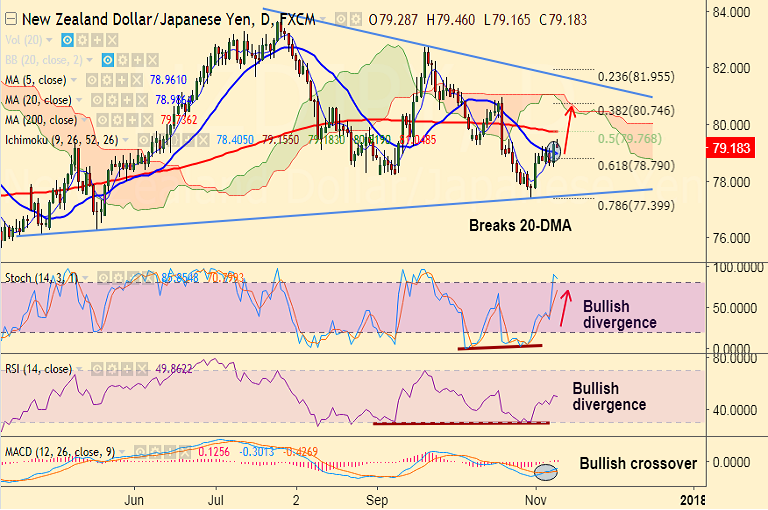

- NZD/JPY consolidating break above 20-DMA at 78.99, bias higher.

- RBNZ left rates unchanged at 1.75 percent, the Kiwi found support from the policy announcements, which forecasted rates rising in Q2 2019 vs Q3 previously.

- However, gains short lived, pair erases RBNZ decision-led gains, slips lower on RBNZ Assistant Governor McDermott’s currency jawboning.

- McDermott noted that it would be good if the NZD fell more. Also, the mixed China inflation data provided little support.

- Technical indicators for the pair have turned bullish. Stochs are biased higher and bullish divergence on RSI and Stochs adds to upside bias.

- We see scope for test of 200-DMA at 79.73 as long as pair holds 20-DMA support at 78.99.

- Retrace below 20-DMA will see resumption of downside. Test of 78.30 levels then likely.

Support levels - 78.99 (20-DMA), 78.95 (5-DMA), 78.79 (61.8% Fib retrace of 75.626 to 83.910 rally), 78

Resistance levels - 79.48 (Oct 23 high), 79.73 (200-DMA), 80.05 (Mar 10 high)

Recommendation: Good to go long on dips around 79/ 79.10, SL: 78.50, TP: 79.50/ 79.75/ 80.

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at 63.3876 (Neutral), while Hourly JPY Spot Index was at 127.949 (Bullish) at 0520 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest