NZDUSD medium-term perspectives: The pair for the day has stalled last week’s rallies and stuck between 0.6850 and 0.6900 (i.e. between 21DMA & 7DMA).

Hedging interests are mounting ahead of RBNZ’s financial stability report and Governor Spencer’s speech on Kiwi’s side and on the other hand, FOMC members (Kashkari & Dudley) speeches are lined up today.

If the Kiwi central bank remains firmly on hold, as we expect, and the US dollar rises on the delivery of a Fed interest rate rise in December, then NZDUSD should fall to 0.67 by year-end.

OTC Outlook and Options Trade Recommendations:

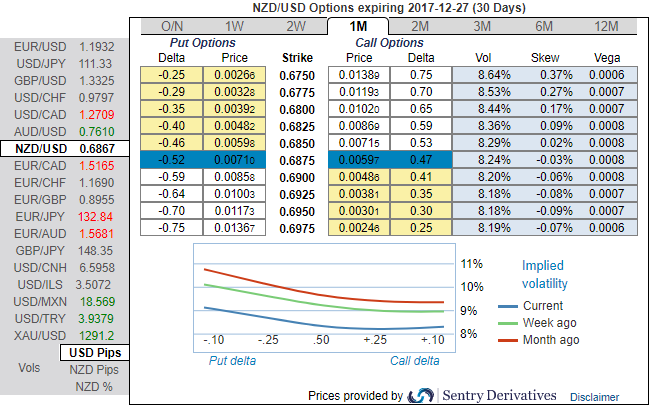

All the factors stated above seem to be discounted in FX options market, please glance through nutshell evidencing IV skews that signify hedger’s bearish interests in next 2-months timeframe. Positively skewed IVs of this tenor signal underlying spot FX is expected to be lowering southwards as the skews have been well balanced flashing positive numbers on OTM strikes.

Also be noted that at spot reference: 0.6860, the 1m skews are targeting OTM put strikes at 0.67, whereas 1w positive skewness is still showing hedgers’ interest in ATM strikes.

Accordingly, we’ve recommended credit put spreads in order to participate both upswings in the consolidation phase and anticipated downside risks.

We recommend writing 1w (1%) in the money put with positive theta snapping decisive rallies. You could easily make out short legs on ITM puts of narrowed expiries are going worthless considering time decay advantage. Simultaneously, we uphold longs in 1m (1%) out of the money put, the structure could be constructed either at the net credit or at zero cost.

Bearish scenarios: NZDUSD forecasts of the slide below 0.67 is majorly driven by:

1) The housing market slowdown becomes disorderly

2) The migration rolls over due to a shift in government policy;

3) NZ bank funding issues intensify, causing the market to question NZ's ability to attract capital inflow.

1w IVs are on the lower side, accordingly, theta shorts are recommended in this strategy because Theta is not a constant, it changes as the underlying market moves and time passes. Theta is the sensitivity of an option’s value to the passage of time. It is usually expressed as the change in value per one day’s passage of time.

Upon the mounting bearish risk, hedging sentiments are observed as you could see the positively skewed IVs in OTM put strikes of 1m tenors (refer positive IV skews indicate strikes towards 0.67 which is 150-160 pips below our forecasts).

The combination of IV 1w/1m skews suggested credit put spreads that have favored to arrest ongoing upswings in short run and bearish risks are to be taken care by 2m OTM longs.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -50 levels (which is bearish) ahead of RBNZ’s governor’s speech, we expect the RBNZ to still be somewhat cautious tomorrow morning, perhaps disappointing market looking for a slightly more hawkish tone. While hourly USD spot index was at shy above -121 (extremely bearish) while articulating (at 06:43 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts