Please be noted that the rising USDTRY IVs have been signaling CBRT is going to be bringing change in its monetary policy that is scheduled today. As shown in the diagram, ATM IVs of 1m and 10d tenors have successively been rising above 20% and 27% respectively which is on extremely higher side, since the spot Fx of underlying pair is rising along with IVs, this is good news for option writers as such options with a higher IV costs more. Thereby, writers are likely to receive more premiums.

This week brings the much awaited Turkish central bank rate decision (today): In the meanwhile, here's something to note some significant aspects. Last week, a research paper by CBT staff estimated that average lira pass-through per year in recent years has been around 15%.

This in itself is a significant number: Turkey has exceeded its inflation target of 5% for a very long time indeed, and recorded close to double-digit inflation in many years; this is hardly surprising if exchange rate depreciation itself is adding 15%-pts of inflation pressure - which, in turn, is the result of CBT's reluctance to maintain a clearly positive real interest rate.

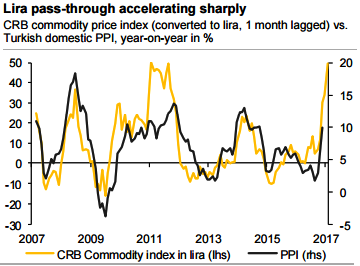

Anyway, what is relevant now is not the historical average pass-through, but what ongoing lira sell-off is doing to import prices today: the above chart explains the YoY change in world commodity prices converted to Turkish lira - this works as a good lead indicator of what domestic manufacturing prices could be doing in coming months.

This measure of pass-through has accelerated from just 10% YoY as recently as in November 2016 to around 50% YoY now. Had the lira instead been stable at 3.00 vs. the dollar, pass-through would be running at only c.5%. This exercise highlights just how crucial it is that CBT act decisively soon to stop this spiral.

Well, amid higher vols circumstances, if you think vanilla structures are risky ventures, options spreads like positions are more conducive as the underlying spot FX is still hovering around all-time highs. The traders tend to view the call ratio back spread as a bullish strategy because it employs more calls. However, it is actually a volatility strategy.

So entering the position when implied volatility is high and waiting for the inevitable adjustment is a smart approach, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a “price neutral” approach to options, and one that makes a lot of sense.

Hence, we advocate initiating 1 lot of 2w ATM +0.53 delta call and 1 lot of 2w (0.5%) OTM 0.49 delta call, simultaneously, short (0.5%) ITM call of similar expiries as shown in the diagram. One could achieve positive cashflows as the underlying spot keeps flying above 3.90.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis