The long-awaited October EU summit is now less than a week away and optimism that the UK and EU can secure a withdrawal agreement has continued to build since the end of the UK political conference season. The sense that the end-game to the two-year Brexit saga is nearing has lifted GBP by 1.5%. The index stands just below the April 2018 high, which itself was the best level since the ill-fated referendum. Indeed, the index is rather delicately poised equidistant between its pre-referendum level and the post-referendum trough (8.5% from either).

OTC outlook:

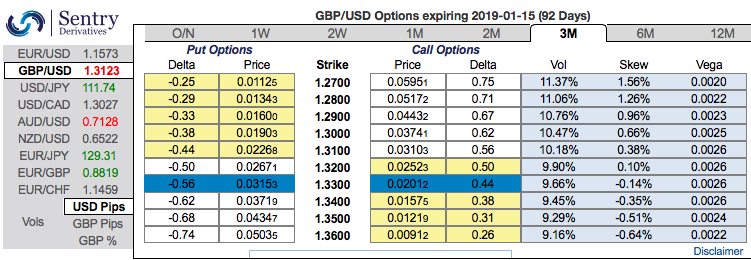

Positively skewed implied volatilities still signal bearish hedging sentiments. To substantiate this downside risk sentiment, negative risk reversals indicate mounting bearish sentiments.

We reckon that the sterling should not suffer like before in the near terms, but, one should not disregard Fed’s hiking cycle and Brexit negotiation on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

Both the speculators and hedgers of GBPUSD are advised to capitalize on the prevailing price rallies for bearish risks and bidding theta shorts in short run (1m IVs) and 3m risks reversals to optimally utilize delta longs.

On hedging grounds, fresh delta longs for long-term hedging comprising of ATM instruments and OTM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 1m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, initiate longs in 3m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in short run and bearish risks in long run by delta longs.

The political and economic backdrop remains supportive of sterling’s underperformance. We continue to be short but take partial profits by unwinding the GBPUSD expression of the trade since this is currently in the money but has only less than a week to expiry and is close to the strike.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -77 levels (which is bearish), hourly USD spot index has bearish index is creeping at -42, while articulating (at 12:10 GMT). For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation