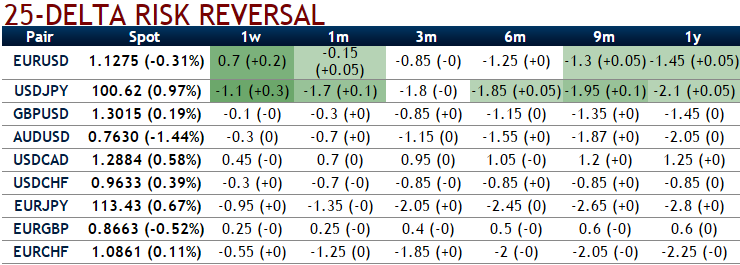

As the delta risk reversals of EURJPY have again shown in bearish interests as the progressive increase in negative numbers signify the traction for hedging sentiments for further downside risks in both short and long term.

Accordingly, the yen has been soaring against the euro after a round of modest monetary policy easing from the Bank of Japan disappointed investors in the recent past who had been hoping for at least a hint of more radical stimulus.

Amid the apprehensions on perimeters of the policy arsenal at the ECB and rising euro-centric risks, we recommend maintaining shorts positions in EURJPY for medium term hedging but by capitalizing on every short term upswing, preferably via options during upcoming ECB meetings.

From these risk reversal numbers, am hedging framework can individually be tailored, structured to meet your needs. You can define:

The risk reversal allows for a customized hedging solution, tailored to your risk and hedging profile. risk reversals are OTC derivative instruments and the notional amount does not need to be tied up throughout the full tenor of the trade.

Nonetheless, usual margin requirements still apply. Usually, risk reversals are structured as zero premium hedging solutions.

Currency or precious metal pairs, Tenor, Notional amount, Lower strike, Higher strike, Leverage factor (ratio), Upfront premium, usually zero cost.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields