AUDUSD in medium term perspectives: At a risk of testing 0.7800 during the next few weeks as USD longs are pared. Longer term we expect to see it slightly lower to around 0.7600. A steady hand from the Fed in June plus an optimistic RBA should limit downside on AUDUSD during the next few months.

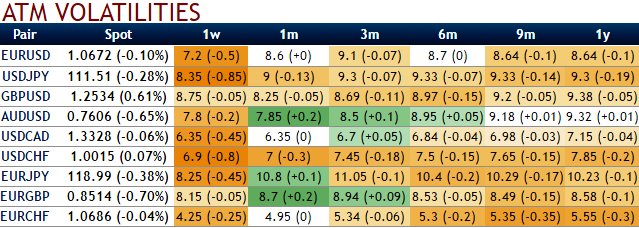

Consequently, the implied volatility for near month at the money contracts of this APAC pair has been dropped below 7.8% for 1w and 8.5% 3m expiry.

While delta risk reversal reveals divulge more interests in hedging activities for downside risks. As a result, we can understand ATM puts have been costlier where the spot FX market direction of this pair is heading towards 0.76 technical levels where we see stiff resistances. So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings and bid on 3m risks reversals.

The OTC options market appeared to be more balanced on the direction for the pair over the 3m to 1y time horizon and as a result delta risk reversal for AUDUSD has been maintaining negative which means puts are in higher demand and overpriced comparatively.

Hence, AUDUSD's lower IV with negative delta risk reversal can be interpreted as the market reckons the price has downside potential for large movement in the days to come which is resulting option writers on competitive advantage and making derivatives instruments for downside risks have been overpriced and fresh shorts are more on the cards.

Hence, we advocate selling AUDUSD 3M 25D RR.

Buy 1m AUDUSD vs AUDNZD vol spread, equal vega.

Buy 3m AUDUSD ATM vs sell 1y AUDJPY 25D Put, 1.5:1 AUD vega.

Long 2m AUDUSD 0.71-0.6860 put spread; sell 2m AUDUSD 0.7650 call.

Long a 4m NZDUSD 0.62 put with a 0.65 KO in AUDUSD.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes