After 3-4 days of bearish streaks in USDMXN, bulls have resumed again in its major bull trend, spiked from the lows of 20.1265 levels to the current 20.6205 levels, rallies continued after Mexican central bank’s monetary policy announcements on Thursday. A lot needs to go right for MXN to get stronger Banxico’s 50bp rate – well expected by consensus and smaller than priced by the market – failed to help the beleaguered peso, which opens up an opportunity to get long USDMXN.

Rate hikes alone will be insufficient to turn around the currency, though more aggressive action could mitigate downside pressure.

As a result, the peso would be on a downward track through to Q1 due to continued pressure on EM currencies as the market adjusts to higher bond yields and a re-rating of Fed expectations coupled with uncertainty regarding Trump’s trade and immigration policies. The 19.9 -20.0 area (previous peak in late September) should offer good support with a move to 23 being our baseline scenario.

Risk premium has fallen, but remains elevated – positioning is still short dollars but has room to increase, MXN is cheap versus oil prices, and implied vol is elevated (though skew has normalized).

However, a lot will need to go right for Mexico (oil, yields, Fed, Trump) to scare away the shorts and the lingering threat of Trump nixing or renegotiating NAFTA prevents a bullish trend from developing.

Brexit and NAFTA are different animals, but price action in GBP could be instructive to understand how the peso might trade – GBP rallies have been limited and shorts positions have been very sticky.

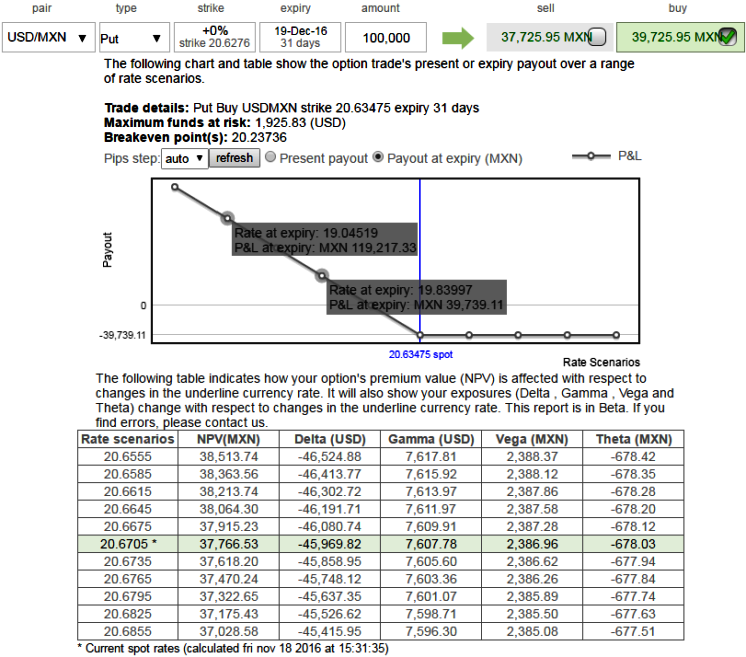

Hence, we encourage longs in USDMXN at spot references of 20.62 for a target at 23.5 and a stop at slightly below the previous peak in late September at 19.8 (-4.0%) but add protective ATM delta puts at the same juncture as the 1w ATM IVs are spiking frantically above 21.6% which is quite conducive for option holders when underlying spot keeps plummeting in next 1weeks’ time; this is quite evident in payoff structure during various underlying rate scenarios.

Elevated volatility argues for a modest initial capital allocation. The time horizon is 3-6 months with negative carry of 40bp/month

Risk profile: (OPEC, Fed, bond yields)

Trump factor, a sustained increase in oil prices could marginally help the MXN; most importantly, watch the November 30th OPEC meeting. Additionally, a turn in bond yields, moderation in Fed tightening expectations, or a marked shift in Trump’s stance toward protectionism would help the MXN.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes