Sometimes appearances are deceptive. The decision of the Mexican central bank at the end of March to leave interest rates unchanged was no surprise. The only surprise for some market participants was at most how clearly the central bank pointed out the upside risks to inflation in its statement, instead of making a neutral turn against the background of the weak economy and the recent decline in inflation.

However, the minutes of the meeting offered a greater surprise. Gerardo Esquivel-Hernandez, who had just joined the board, also voted for unchanged interest rates, but against the content of the statement. He did not agree with the restrictive tone of the statement and the conclusion regarding the risks for inflation. This is critical because Esquivel has been appointed by President Andres Manuel Lopez Obrador, who favors a more expansionary monetary policy. Since Lopez Obrador will fill 4 more positions on the board during his 6-year term of office, there are fears that more doves could join the central bank. This is not relevant in the short term; since no new appointments are pending, therefore the MXN hardly reacted to the publication of the minutes at the end of last week. However, since central bank policy has been an important support for the peso in recent years, investors should watch the developments in this respect carefully. Already now we are cautious regarding the peso due to domestic political risks posed by the new government and its president Lopez Obradpor.

We, therefore, do not reckon the current levels sliding below 19 in USDMXN to be sustainable.

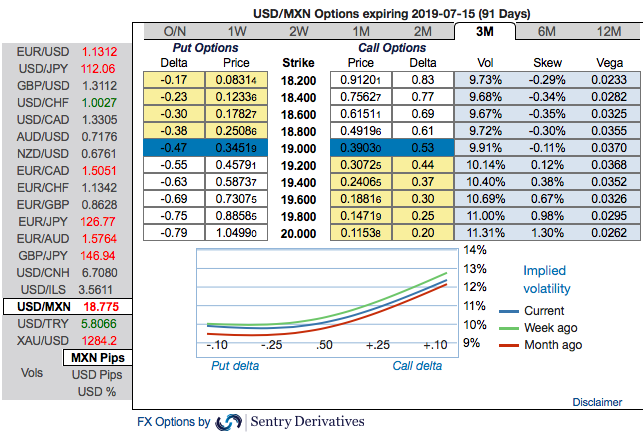

OTC updates: Of late, MXN seemed to be extending recovery threatening upper bound of the recent range.

But please be noted that the 3m USDMXN implied volatility skews signal continued upside risks. The previous massive sell-off of Mexican peso caused a vol surface dislocation, nudging skews to the highest since the 2016 US Presidential elections. Delta hedged 1*1.5 ratio call spreads exploit the dislocation while also having historically offered a superb performance. +1Y/-3M calendars of risk reversals take advantage of the lagging back-end vs front-end implied skews. Courtesy: Commerzbank & Sentry

Currency Strength Index: FxWirePro's hourly USD spot index was at -97 levels (bearish) at 13:44 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data