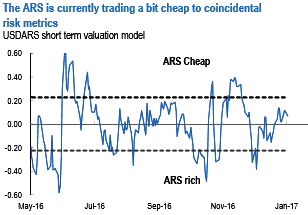

We encourage holding longs in ARS, short USDARS. The peso is currently trading a bit cheap to coincidental risk metrics (refer above chart), helped by soy prices, the positive real rate enforced by the Central Bank to prevent further inflation expectations de-anchoring, and high agricultural export proceeds for the season of the year.

The trade balance posted a US$2.1bn surplus in 2016, a sharp turnaround from the US$3.0bn deficit in 2015.

Imports contracted US$4.1bn last year, explaining 81% of the swing in the trade balance.

2016 primary fiscal deficit (ex.-tax amnesty fiscal inflows) was 6.0% of GDP, well above our 5.0% forecast.

Short USDARS, we remain constructive on ARS and continue to recommend selling 3m and up to 6m USDARS NDF as one of the few carry trades where we expect the positive total return.

The recent macro news supports this outlook, as our nowcaster suggests that Q4’16 GDP expanded by 5% QoQ SAAR, materially better than our prior 3.2% forecast.

Stay short in USDARS via 6-month NDF (sell at 15.86).

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom