We reckon that a period of disenchantment with the euro is going through. Couple of months ago, if it appeared as if the euro zone would integrate further, following the election of Emmanuel Macron as French President in particular, however, this delightful impression is fading increasingly. There is disenchantment with Macron himself in France. He is suffering from a loss of ministers and has to reshuffle his cabinet. His reform plans are very contentious amongst the population. The toing and froing about the Italian budget on the other hand illustrates that the debt issue is far from off the agenda in the euro zone either - regardless of QE.

According to Klaas Knot (Bank of Netherlands), member of the ECB’s governing council, the risk of contagion for other euro zone countries is limited, but on the other hand it is not the task of the ECB to correct or compensate for purely national policies. A crisis scenario seems unlikely, but the issue would remain as an apprehensive for the euro.

We are near-term neutral EUR despite a resolute ECB given softer data. ECB is a long way from hiking and trade tensions are worsening. On the flip side, NAFTA has become the dominant driving force for CAD in the near-terms, as the negotiation process has seemed to enter its end stage.

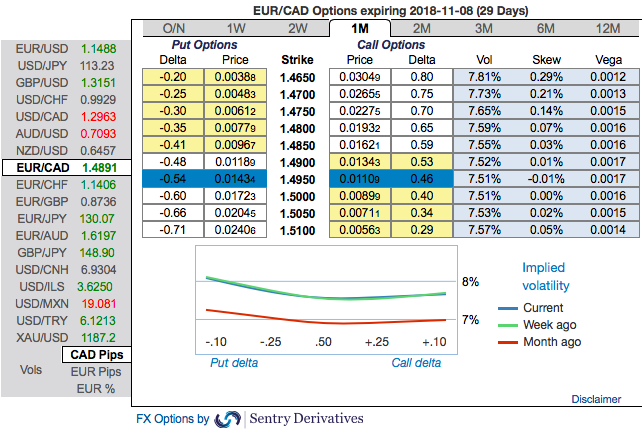

EURCAD OTC outlook:

While 1m IV skews have been well balanced on either side and signify the hedgers’ interests on both OTM call and put strikes. Amid bearish sentiments with lower IVs are interpreted as conducive environment for writing overpriced OTM calls. Using three-leg strategy would be a smart move to reduce hedging cost.

Options Strategy:

Contemplating above driving forces and OTC indications, we advocate initiating longs in 1M EURCAD at the money -0.49 delta put, and go long in at the money +0.51 delta call of similar expiry and simultaneously, short 1w (1%) out of the money calls. Thereby, we favor slightly on downside risks as short leg likely to reduce long legs.

Currency Strength Index:

FxWirePro's hourly EUR spot index is flashing at -86 (which is bearish), while hourly CAD spot index was at -40 (bearish) at 09:18 GMT. For more details on the index, please refer below weblink:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed