The semi-annual Congressional testimony of Fed chair Janet Yellen was the most important event of this week – so far. Not surprisingly, it did not reveal anything new in comparison to the minutes of the FOMC’s June meeting: Inflation will be the key factor for any decisions about rate hikes. The recent re-pricing in rates markets for DM central banks appears stretched for some countries, in particular for CAD and NZD. Canada would be of interest ahead of the BoC next week given the recent hawkish shift by the central bank.

Dollar bears may be frustrated by Fed tightening and a reluctance to tolerate stronger currencies elsewhere. The clearest winner should be the euro, as the ECB can’t normalize policy (even slowly) and expect current valuations to persist, but it won’t like that much.

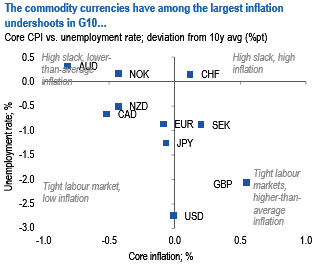

The above chart shows that Canada’s inflation undershoot is larger than that of the US and labour markets nowhere as tight, yet markets price in similar policy rates by the end of 2018.

We thus have a bearish bias on CAD going into the meeting although relatively strong data momentum in Canada and the unexpected nature of BoC’s shift means that overall exposure to this is relatively light (we are implicitly short CAD vs USD through DXY).

Similarly, the Antipodean strategists think that the rates markets price in too much for the RBNZ. We are short NZD in the recommended portfolio but this is maintained vs. BRL. The expectation of a limited bond market sell-off also indicates that EM weakness should be contained as well.

The EM strategists have net reduced risk in EMEA EM but only to currencies which are most vulnerable. We thus maintain long exposure to select EM currencies where idiosyncratic factors are still supportive. This includes long CZK and ILS among the low-yielders. Exposure to high yielders like TRY and BRL are held versus other high beta currencies with lower carry, specifically ZAR and NZD to reduce beta to changes in risk sentiment. These currencies also have similar betas to yields so such pairings provide the cushion against higher yields as well (refer the second chart).

The resulting portfolio is thus positioned on primarily the following themes: in G10, short global rates (via short EURJPY outright and through call RKO), selectively long carry in low-beta format (short NZDBRL, long TRYZAR) and long currencies with strong idiosyncratic drivers (long ILS on strong external balances, long CZK on policy normalization and valuations).

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal