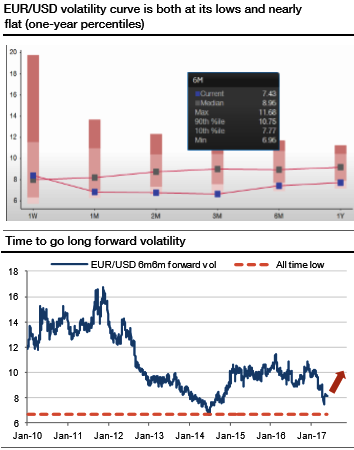

After the French presidential election, the EURUSD volatility curve aggressively sold off, reaching its lowest level since 2014. Since then, implied vols have bounced only very timidly and are still very close to their recent lows (refer above graph). Interestingly, the curve is usually quite steep when vol is globally low, and conversely, it tends to flatten or even invert when vol rises. The current configuration – a nearly flat curve combined with low volatility – looks like an anomaly, as the vega part should include a term premium when the front end is very low.

Curves are usually driven by the front end, and the risk priced there is then diffused towards the longer tenors. But even if short-term volatility remains subdued, we can contemplate the steepening being driven by the vega part of the curve in a context where the market is not shaken by near-term fears but starts discounting the medium-term outlook. EURUSD 6m volatility in six months offers a great opportunity, as it is trading only about one volatility point above its all-time low (refer above graph).

The uncertain and reflationary environment should involve a premium in vega vols, with the flat curve making forward volatility very attractive to buy. We recommend going long an EURUSD 6m6m forward volatility agreement at 7.8.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts