As there are significant data releases scheduled on CHF side for this week and near future EURCHF is likely to experience low volatility. You can make out from the nutshell, EURCHF is to have the least IV.

Off-late, Swiss has produced upbeat manufacturing PMI and retail sales numbers that would propel CHF's gains. In addition that healthy Swiss trade balance has printed at 3.05 billion which is a way beyond previous record at 2.86 billion, this week's key focus would be on unemployment claims.

Currency option strategy through Condor construction: EURCHF

We predict marginal upswings on daily charts with clear converging signals from RSI (14) and stochastic curves. Although there is no trace of drastic or dramatic movements on either side we still sense some sort of upward momentum.

Since the EURCHF's implied volatility is perceived to be minimal, so here comes a multiple leg of option strategy for regular traders of this currency cross when there is little IV. A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

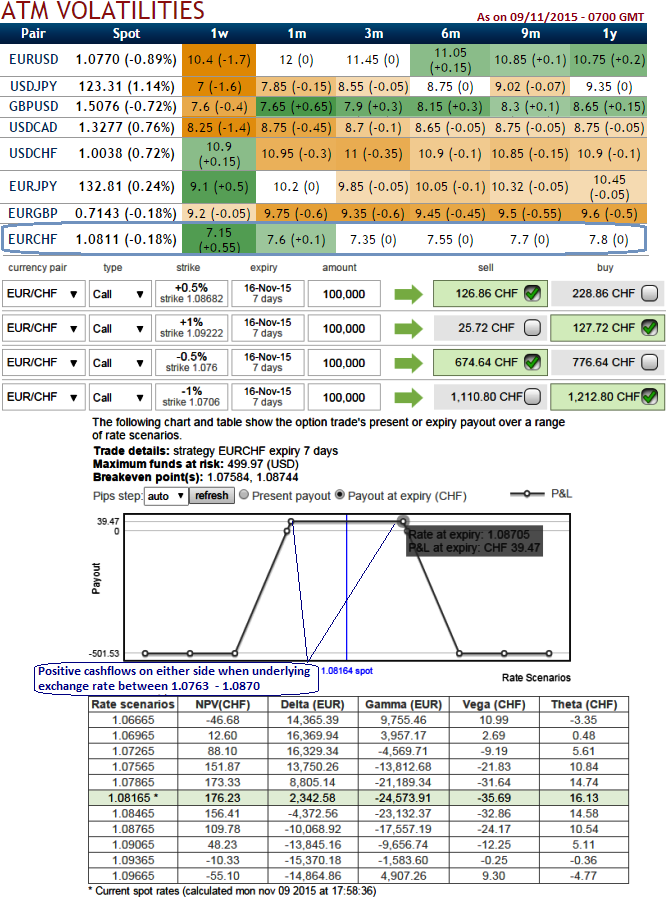

The trader can construct a long condor option spread as follows,

As shown in the figure, the trader can implement this strategy using call options with similar maturities.

So strategy goes this way, writing an In-The-Money call and buying deep striking in-the-money call, writing a higher strike OTM calls and buying another deep striking out-of-the-money call for a net debit.

FxWirePro: Low IVs portray Condor Spreads construction on EUR/CHF

Monday, November 9, 2015 12:44 PM UTC

Editor's Picks

- Market Data

Most Popular