CAD investors are torn between two opposing scenarios: on the one hand the Canadian economy has overcome the collapse of the oil price in 2014/2015 and is recording decent growth rates once again, and as a result signals towards a normalization of monetary policy are emerging from amongst members of the Canadian central bank (Bank of Canada, BoC).

On the other hand, the renewed downtrends in the oil price, as well as the protectionist approach on the part of the US administration, entail new economic risks. The US administration announced only yesterday that it would introduce anti-dumping duties on timber imports from Canada thus escalating a trade dispute with its neighbor that had been simmering since November.

Investors are likely to now be waiting for an indication from BoC governor Stephen Poloz and vice governor Lynn Patterson, who are both taking part in an ECB forum in Portugal, on the BoC’s future approach over the coming days. Should both continue to sound optimistic – despite the above risks – CAD will be able to make further ground against USD.

OTC Outlook and Options Strategy (USDCAD):

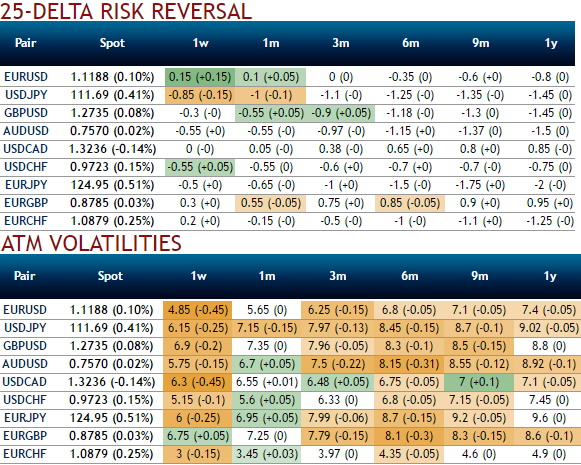

Please be noted that the above nutshell showing IVs and risk reversals of this pair, that has been neutral. Implied volatilities have been extremely lower among the G7 FX space and you could also make out that there have been no hedging sentiments (neutral risk reversals in 1w tenors and with bullish neutral hedging sentiments in 1m-1y tenors).

Well, contemplating these OTC indications, using collar spread options strategy, the investor gets to earn a premium on writing overpriced calls, simultaneously add a protective at the money put option. Appreciate all benefits of underlying spot outrights moderately. If he’s having FX payables unless he is assigned an exercise notice on the written call and is obligated to sell his spot outright holdings, this strategy is a risky venture.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?