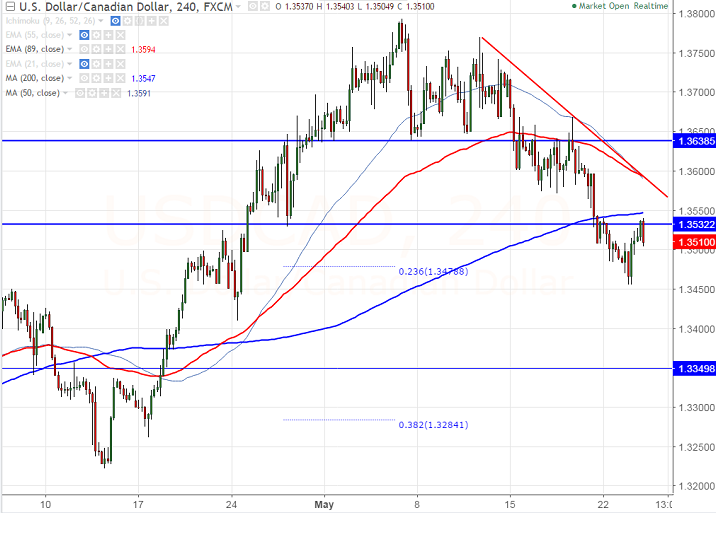

- USD/CAD hits fresh 3rd week low and shown a mild recovery from that level. Short term trend is still weak as long as resistance 1.3595 (89 4H EMA) holds. It is currently trading around 1.35406.

- WTI Crude oil hits fresh two week high after breaking major resistance at $51.40 and jumped till $51.85 on account of expectations of extension of output cut in OPEC meeting to be held in Vienna on May 25th 2017.

- USD/CAD major short term resistance is around 1.3546 (200 4H MA) and any break above confirms minor bullishness, a jump till 1.3595 likely.

- On the lower side, near term support stands at 50- day MA at 1.3480 and any close below confirms further weakness. Any close below 50- day MA confirms that decline till 1.3410. Any break below 1.3410 confirms that jump from 1.2964 comes to an end and dip till 1.3285 (200- day MA) likely.

- The near term resistance is around 1.3540 (200- 4H MA) and any break above will take the pair till 1.3595 (50- 4H MA)/ 1.3640 (support turned into resistance). Any close above 1.3838 (61.8% fibo) confirms bullish continuation.

It is good to sell on rallies around 1.3530 with SL around 1.3595 for the TP of 1.3410/1.3290.

Resistance

R1-1.3545

R2 -1.3595

R3- 1.3640

Support

S1-1.3480

S2-1.3410

S3-1.32850