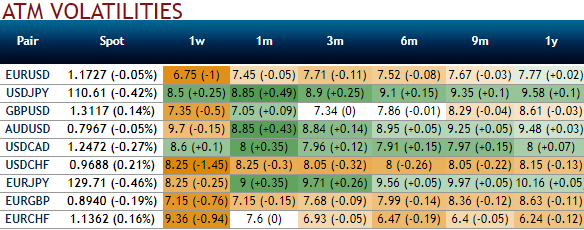

Please be noted that the OTC VIX for EURCHF has been the highest, but IVs of longer tenors have still been on the lower side, while risk reversals indicate the hedgers’ interests in the bullish risks.

With limited room for Euro appreciation and the near certainty of a vol slump in the event of a traditional party appear to prevail in German or Italian elections and ECB becomes more hawkish. long delta/short Vega strategies such as EUR call flies appeal, and are well-priced in EURCHF.

Higher leverage expressions of Euro strength are [EUR/CCY higher, USD/CCY lower] and [EURUSD higher, EuroStoxx higher] dual digitals.

EUR-crosses have historically displayed widely varying sensitivities to crash risk in the Euro, with EURHUF, EURPLN, EURAUD, and EURNZD all tending to rally during Euro-stress, and EURJPY, EURGBP and EUR/Asia selling off sharply.

Consider buying zero-cost combinations of low delta EUR puts in the latter camp funded with EUR puts in the former as conditional expressions of EUR crash risk.

Deep value is beginning to emerge in long-end (5Y) USDCHF vol.

Long/short pairs of USD calls/CHF puts funded with EUR calls/CHF puts are priced at multi-year lows and offer franc view-neutral positive carry.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics