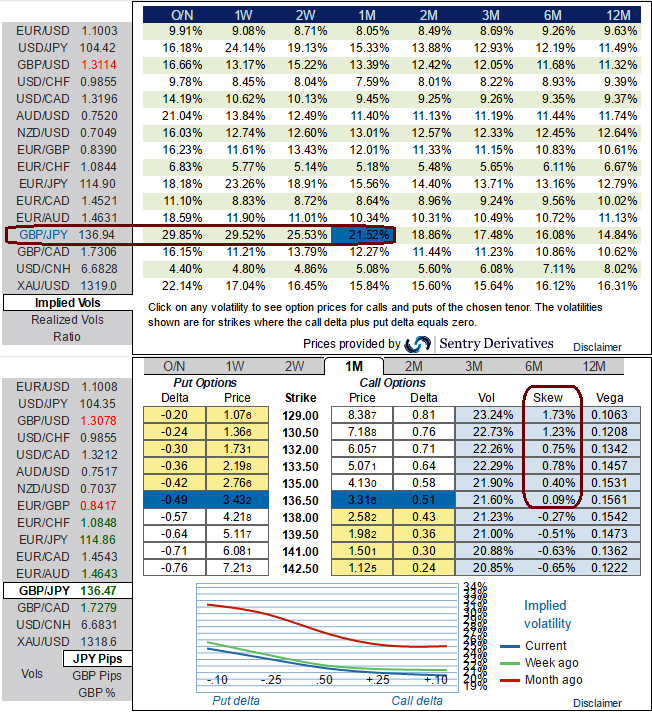

Please have a glance on how implied volatilities of ATM contracts of 1w, 2w, and 1m tenors are spiking crazily in OTC markets, 29.52, 25.53% and 21.52% respectively ahead of Bank of Japan's monetary policy on Friday.

Technically, GBPJPY’s downtrend to prolong after very brief upswings, the pair has shown whipsaws pattern to the previous brief upswings and rejected the resistances at 142.390 levels. The current prices have also drifted below 7DMAs, so major downtrend would likely continue in the long run.

Since the 1w ATM IVs of this pair flashes the highest numbers among G20 currency space, well then it would be smart move to use the brief upswings to deploy bearish hedging strategies along with HY IVs. You can also cautiously observe skews in IVs of 1-month tenor signal the bears’ interest in OTM put strikes.

BoJ likely will ease next week, using all existing tools, while the government may release the outline of its fiscal package.

On the flip side, with BoE’s odds of cutting bank rates are increasing, FX option markets have been factoring GBP depreciation is divulging the extreme weakness in this pair and it means the market thinks the price has the potential for large movement in the downward direction.

Hence, we advocate the suitable strategy to hedge these downside risks by using these small bounces from then to help our ITM shorts but major motto is to load up as many longs as possible to mitigate the bearish risks.

So, stay firm with longs on 2 lots of 1M At-The-Money vega puts that would function effectively in higher IV times, while shorts side of 1 lot of 1W (1%) ITM put option would generate assured returns on any abrupt rallies.

The Vega would be at its maximum when the option is at ATM and declines exponentially as the option moves ITM or OTM owing to every tiny shift in IVs that will make no difference on the likelihood of an option far out-of-the-money expiring ITM

ATM options are far more sensitive since higher IV greatly increases their chances of expiring ITM which is why we prefer ATM strikes to adding more weights in longs of this strategy.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices