In recent times, we upheld our long gold trade recommendation ahead of the largely uncertain risks around Trump’s inauguration and the kick-off of his presidency. Obviously, both those immediate catalysts have passed but arguably, much of the uncertainty remains. Yet, from our perspective now, we view this lingering ambiguity as a potential extra accelerant to a near-term, fundamental-based rally in gold.

On treasuries, Fixed Income research analysts reiterate that “there is room for yields to decline over the coming weeks” given their skepticism on large-scale fiscal stimulus and the potential for growth to moderate among other drivers like seasonality and stretched investor positioning to the short side.

From an FX perspective, while long dollar positioning remains material even after the retracement lower in the dollar index YTD, our analysts believe, “the broad dollar does still seem vulnerable should Trump’s first several days in action disappoint those looking for primarily growth-friendly and reflationary policies, without stoking disruption or trade-confrontation risks.”

Combining these macro views with the general sense of uncertainty in markets (safe haven demand) and the relatively clean investor positioning in gold, compels us to recommend going long in gold.

In our recent articles, we’ve already advocated initiating long Apr’17 CME gold futures at a spot price of $1,232.80/oz today.

OTC outlook and hedging strategy:

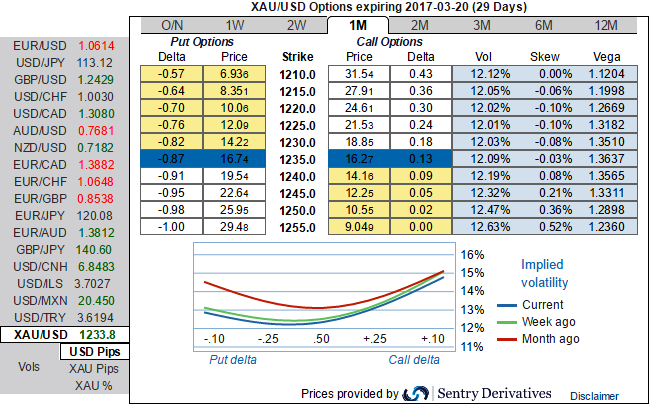

Delta risk reversals of XAUUSD: From the nutshell showing delta risk reversals of gold prices, you can probably make out that this commodity has been the most expensive pairs to be hedged for upside risks as it indicates calls have been relatively costlier over puts, but short term (1m tenor) upside risks are more than that of 3m tenors

As it showed the highest positive values which indicate the upside risks of spot FX is anticipated and hedging for such risks is relatively more expensive.

Needless to specify, Gold price vols have still been flying with sky rocketed pace no matter what both prior and post monetary policies of Federal Reserve of the US, but this time these IVs are also owing to safe haven investment sentiments.

Since the implied vols are accelerated in high pace that is conducive for option holders. Hence, we recommend options straps to hedge further upside risks of XAUUSD.

Here is how the strategy should resemble, longs in 2 lots of 1M 0.51 delta calls while long in 1 lot of -0.49 delta put option of 3m tenors, the hedging portfolio is constructed at net debit with 56% of the net delta.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data