Bearish NZDUSD scenarios below 0.67 given following factors:

1) The NZ housing market slowdown becomes disorderly;

2) NZ immigration rolls over quickly;

3) NZ bank funding issues intensify, causing the market to question NZ's ability to attract capital inflow.

NZD faces domestic headwinds to local rates that are only now being fully appreciated. Growth has weakened, the central bank’s inflation forecasts have been revised materially lower, net immigration is slowing and business confidence has fallen significantly since the change of government.

The US dollar should strengthen further if the Fed hikes further this year, and that will push NZDUSD lower. In addition, the NZ-US interest rate advantage has been eroded, removing one of the previous attractions of the NZD. Further, domestic data is indicating the NZ economy is slowing. We expect NZDUSD to fall to 0.68 by Sep, and 0.67 or lower by Dec.

Technically, NZD bears in the major trend which was in consolidation phase are extending triple top formation. Evidently, steep slumps are observed below EMAs, both leading indicators have been in bearish bias.

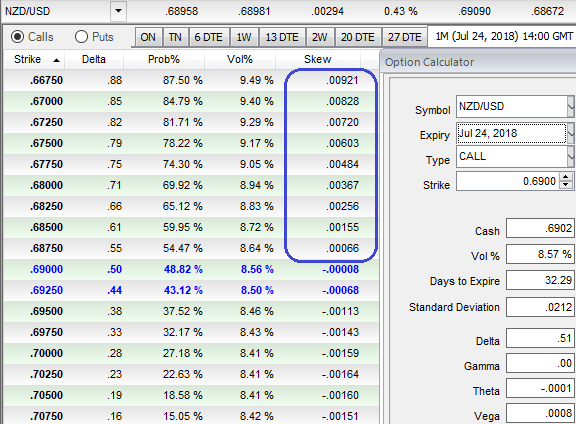

OTC outlook:

Bids on 1m skews have come in quite worthy for bears, as they signaled the hedging interests for further bearish risks. Thus, Bids are upto 0.6675. Accordingly, we’ve recommended put ratio back spreads in order to participate both momentary upswings in the consolidation phase and anticipated downside risks.

The underlying pair has been spiking higher from the last couple of days, the upward correction shows no signs of fading, 0.70 the next target if risk sentiment remains upbeat.

Well, for now, the medium term perspectives of this pair seems to be bearish as the US dollar remains in a two-month-old sideways range, which means further sideways ranging in NZDUSD is possible during the month ahead.

Further out, though, we are bearish. The NZ-US interest rate advantage is rapidly shrinking and should eventually weigh, pushing NZDUSD towards 0.70 by mid-year.

Moreover, the 3m skews are targeting towards OTM put strikes at 0.66 (refer above nutshell) which is in line with the above-mentioned projections.

Writing 1m at the money put with positive theta snaps momentary rallies, you could easily make out short legs on ATM puts would go worthless considering time decay advantage. Simultaneously, we uphold 2 lots of longs in 1m 1% OTM puts, the structure could be constructed at net debit.

It was explicitly stated that “Theta shorts are recommended in this strategy because, Theta is not a constant, it changes as the underlying market moves and time passes. Theta is the sensitivity of an option’s value to the passage of time. It is usually expressed as the change in value per one day’s passage of time.”

Hence, on hedging grounds, the option the holder of OTM puts still desirable and is deemed to be on upper hand.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -24 levels (bearish), while hourly USD spot index was at -74 (bearish) while articulating at 08:52 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data