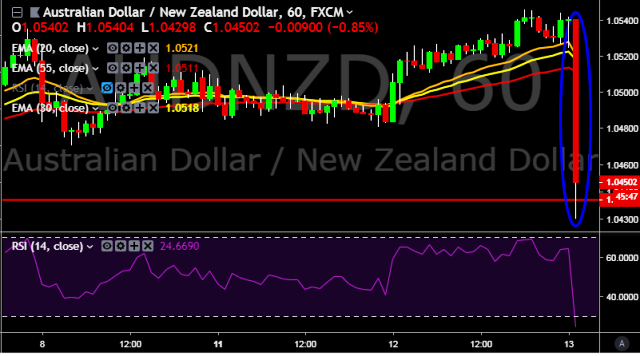

- AUD/NZD is currently trading around 1.0445 marks.

- Pair made intraday high at 1.0543 and low at 1.0429 marks.

- Intraday bias remains bearish till the time pair holds key resistance around 1.0545 mark.

- A sustained close above 1.0531 will drag the parity higher towards key resistances around 1.0545/1.0570/1.0590/1.0634/1.0712 levels respectively.

- Alternatively, a daily close below 1.0463 will take the parity down towards key supports around 1.0432/1.0365/1.0333/1.0237 marks respectively.

- New Zealand cash rate stays flat at 1.75 % (forecast 1.75 %) vs previous 1.75 %.

- RBNZ sees official cash rate at 1.75 pct in March 2019.

- RBNZ says monetary policy expects to keep the OCR at this level through 2019 and to 2020.

- RBNZ sees official cash rate at 1.84 pct in Dec 2020.

- RBNZ sees official cash rate at 2.36 pct in March 2022.

- RBNZ says the direction of next OCR move could be up or down.

- RBNZ says despite weaker global impetus, we expect low interest rates and govt spending to support pickup in GDP growth in 2019.

FxWirePro: Kiwi strengthens remarkably against major peers after RBNZ’s cash rate decision

Wednesday, February 13, 2019 1:30 AM UTC

Editor's Picks

- Market Data

Most Popular