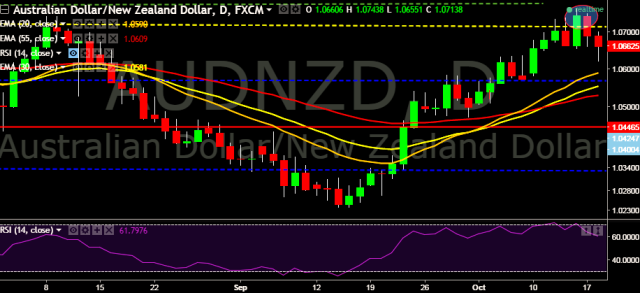

- AUD/NZD is currently trading around 1.0655 marks.

- Pair made intraday high at 1.0701 and low at 1.0621 marks.

- Intraday bias remains bearish till the time pair holds immediate resistance at 1.0751 marks.

- A sustained close above 1.0751 will drag the parity higher towards key resistances at 1.0823/1.0976 (January 2016 high) /1.1062 (30D EMA) /1.1123/1.1298/1.1317 levels respectively.

- Alternatively, a consistent break below 1.0618 will take the parity down towards key supports around 1.0509, 1.0472, 1.0333, 1.0237, 1.0184, 1.0109 and 1.0053 marks respectively.

- New Zealand’s Q3 consumer price index +0.2 pct vs previous qtr (Reuter’s poll 0.0 pct).

- New Zealand’s Q3 consumer price index +0.2 pct vs year ago (Reuter’s poll +0.1 pct).

- RBA also released monetary policy meeting minutes.

- RBA October Minutes: Judged holding rates steady "at this meeting" consistent with inflation, growth targets.

- RBA October Minutes: Board noted Q3 CPI, updated economic forecasts would be available at next meeting.

- RBA October Minutes: An appreciating A$ could complicate economic rebalancing.

- RBA October Minutes: Rising commodity prices likely lifted terms of trade in Q3.

FxWirePro: Kiwi gains against major peers on robust CPI data

Tuesday, October 18, 2016 1:07 AM UTC

Editor's Picks

- Market Data

Most Popular