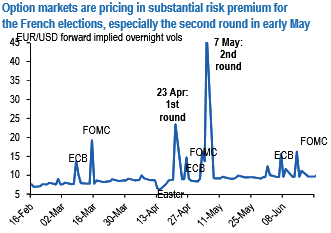

French election risk premia have ramped higher in recent days as the shrinking time horizon and enforcing punchier day-weight marks on gamma books. Overnight implied vols for the two election rounds command a1.5-2 times multiple over standard event weights for central bank meetings, especially for the second round run-off.

It is argued that the pricing spread between the two rounds appears inflated given that the first round itself has the potential to bring significant resolution: were Le Pen to qualify along with a mainstream candidate, it is most likely that a “Republican front” would form to bar her at the second round, of the type that allowed Chirac to collect a landslide 82% of the vote in 2002 against Jean-Marie Le Pen.

Of course, with 2016 having delivered two major upsets at odds with opinion polls, one cannot completely reject the scenario of another major surprise, especially as Fillon’s woes have altered the landscape significantly.

Hence it is more appealing for investors from a risk management standpoint to enter relatively cheap event hedges rather than fade expensive ones.

A relative ranking of overnight event vol across European currencies suggests that EUR/safe-haven crosses (EURJPY, EURCHF) expectedly pack in the maximum risk premium, while EURCEE options appear complacent (refer above chart).

Aside from better valuations, owning delta-hedged OTM EUR puts/PLN calls in particular as proxy Euro-hedges is interesting on a few levels:

The current gamma performance is not stellar, but high-frequency realized vols have picked up smartly this month such that the cost of carrying hedges is less onerous (3M ATM mid 6.25 vs. 4-week hourly realized 5.6-6.0).

Owning EUR puts on the weak (“wrong”) side of the EURPLN risk reversal avoids paying smile theta, unlike in the case of EURUSD, EURJPY or EURCHF where EUR puts are bid substantially over EUR calls.

While market-moving developments on the conversion of CHF-denominated mortgages may not be imminent, vol owners should like the asymmetry of there being little risk premium in either cash or vol for what can be a potent idiosyncratic risk.

The EMEA team is under-weight the currency in the JP Morgan’s GBI-EM portfolio and hold EURPLN call spreads as a directional bearish zloty expression. CEE aside, ZAR–especially EURZAR –is another interesting pair to consider as a Euro-contagion hedge given that implied vols there have collapsed to 2-years lows at par with delivered, and as one of the few currencies to withstand the gamma carnage this month (refer above chart).

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure