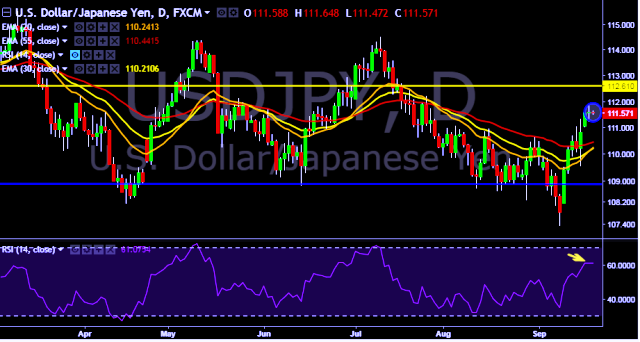

- USD/JPY is currently trading around 111.53 marks.

- It made intraday high at 111.64 and low at 111.47 levels.

- Intraday bias remains neutral till the time pair holds key resistance at 111.89 marks.

- A daily close above 111.58 will take the parity higher towards key resistances around 111.89, 112.86, 113.57, 114.88, 115.50, 117.21, 118.18, 118.66, 119.52 and 120.46 levels respectively.

- On the other side, a sustained close below 111.58 will drag the parity down towards key supports around 110.99, 109.88, 108.12, 107.32, 106.72, 106.03 and 104.96 levels respectively.

- Japan August exports y/y increase to 18.1 % (forecast 14.7 %) vs previous 13.4 %.

- Japan August imports y/y decrease to 15.2 % (forecast 11.8 %) vs previous 16.3 %.

- Japan August trade balance total yen decrease to 113.6 bln jpy (forecast 93.9 bln jpy) vs previous 418.8 bln jpy.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest