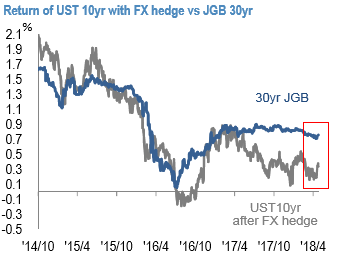

With respect to foreign bonds investments, the shared concern is high hedging costs of late (refer 1st chart). Yet, overall Japanese lifers remain keen to seek investment opportunities outside Japan given the domestic low yield environment. Some expressed willingness to shift from US bonds to European bonds with lower hedging costs; the shift has already been observed in portfolio data since late last year (refer 2nd chart).

Almost all remain keen to increase foreign bonds investments with no FX hedge in FY2018. On average, the bottom of their expected range of USDJPY is low-100 while the average higher end is high-117 (refer 3rd chart). Some mentioned 105 as a critical level for USDJPY and they might increase exposure to FX once the pair falls below the level.

In addition, this would support our view that USDJPY will remain in a range between 103 and 115 as the bottom would be supported by the possible outward flows. Separately, the average higher end of expected UST 10 year yields is 3.3-3.4%. If the UST yields continue to rise and approach the higher end level, or even just stay as high as now, it might encourage outward investments in foreign bonds.

While their investment strategy heavily depends on market environments and could alter over time, if they increase their FX exposure as they wish, it will possibly cause a significant amount of JPY selling. According to the BoJ and MoF data, Japanese lifers recently own roughly ¥83trn foreign assets. While the hedging ratio is likely about 70% now, if they lower 5% by unwinding hedging position, it would cause ¥4trn JPY selling.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -4 (which is absolutely neutral), while hourly JPY spot index was at 44 (bullish) while articulating at 06:58 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms