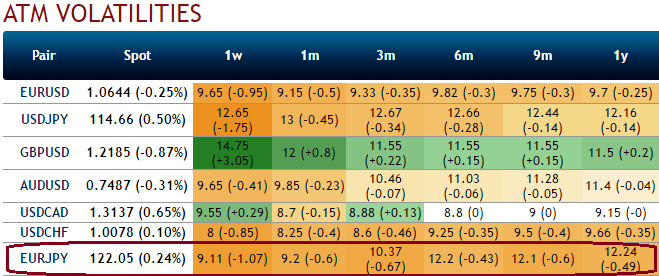

The EUR/JPY volatility surface is offering very attractive opportunities because the skew on the 6m and 1y is currently excessive (refer 4th graph). Where IV skews seem to be mispricing, which is why implied vols of this pair across the various tenors are reducing considerably.

If we’ve to contemplate that the options market is pricing EURJPY risk reversals (RR) as the sum of EUR/USD and USD/JPY RR, the triangle is perfectly priced (refer 2nd graph). The implied volatility of 6m and 1y 25-delta strikes is trading about 3 volatility points higher than ATM volatility, which supposes that the implied volatility should be strongly negatively correlated with the FX rate.

Since 2013, the EURJPY RR has strongly mean reverted towards the vol/spot correlation. However, this correlation has been about zero for a few weeks (refer 3rd graph), such that EURJPY 6m skew is now disconnected from its fair value.

Splitting the EURJPY RR into EURUSD and USDJPY components, like the market, exhibits the source of this mispricing. The EURUSD 6m RR is trading at -1.8 and the USD/JPY at -1.1. The former is consistent with the EURUSD price action, which actually saw downside volatility.

However, USDJPY has indeed been positively correlated with its volatility, hence the EURJPY mispricing comes from the yen side. Investors could directly consider selling the USDJPY excessive skew, but we recommend selling the EURJPY skew instead. It offers a larger risk premium (due to the fairly priced EURUSD smile component), which is opportunistic given our bullish bias on the spot.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data