UK current account deficit is larger than it has been any time since 1985, a record low of -28833 GBP Million in the fourth quarter of 2014.

Tail risk of Brexit caused spike in demand for GPB downside (puts) over USD.

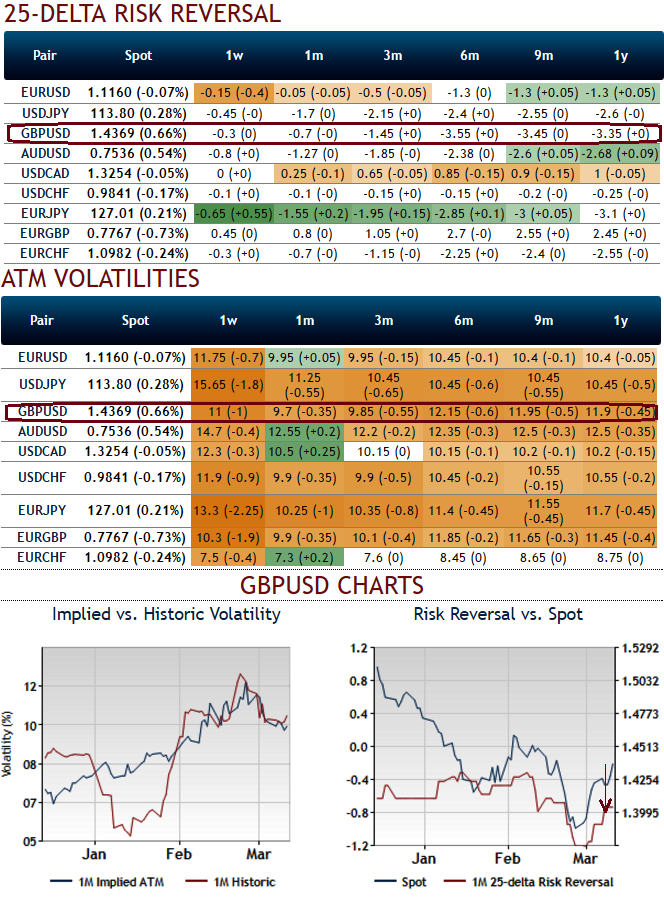

Risk reversals: demand for GBP puts/USD calls have spiked on fears of UK exit from the EU.

We expect the Fed to keep the funds target rate unchanged at 0.50% at this week’s FOMC meeting (announcement due on Wednesday).

The likelihood of significant 'brexit' event will likely keep adding pressure on the GBP through the foreseeable future, while key events in the week ahead could force significant short-term volatility.

We predict the BoE will leave its Bank Rate and Asset Purchase Target levels unchanged. Barring a truly shocking result, the focus thus shifts to the official statement to follow the announcement.

For now, we would still recommend a GBP/USD 3M risk reversal i/o 1Y as a generic hedge for Brexit risk. The ideal entry point is not ideal given the near doubling of the risk reversal since early October, but the bias is for further widening of the skew in 1H on slow-bleed demand for event protection.

As the risk reversals for 1W-1M expiries also indicate that the puts have been relatively expensive and as stated above traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

The current spot FX is trading at 1.4363, we anticipate more dips extending up to 1.35 levels in next 3 months or so. And it is understood that bearish momentum is bolstering as we saw that from delta risk reversal table, bears have been willing to pay higher premiums. Hence, aggressive bears can initiate strategy using ATM puts.

Long side, 2M at the money -0.49 delta puts, 3M (0.5%) out of the money -0.27 delta put and 1W (1%) in the money -0.16 delta put options are recommended. The strategy would be constructed for net debit, narrow expiries are the most essential to ensure the short side expire worthless.

FxWirePro: Is it Fed or BoE? - Hedging GBP/USD further tail downside risks caused by Brexit and UK CAD pressures

Monday, March 14, 2016 1:27 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary