Banxico hiked rates by 25 bps, which is in line with consensus, while the monetary policy statement signaled a clear shift in rhetoric to a more neutral tone from a hawkish one previously.

Mexican curve can steepen further after policy shift.

Both consensus and market expectations were in the camp of only small tightening moves over the next year after today’s meeting. Nonetheless, the shift in policy stance caught the market off guard and resulted in a sharp rally in TIIE swaps (26m -23bp, 130m -14bp).

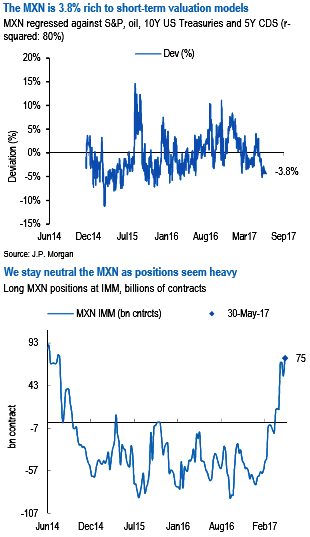

A less aggressive policy stance was a reason, amongst others, for our TIIE steepener trade and long MXN position. On the rates front, our steepener trade (initiated Apr 28) was early and the position is a little bit underwater, but the curve should normalize from here and re-couple with the US curve over time.

We prefer to receive rates instead of being long MXN for a bullish view in Mexico while keeping long hedges to keep bullish MXN risks on check via below option spreads.

OTC indications and Options strategy:

Please be noted that the negatively skewed implied volatilities of USDMXN of 6m tenors indicate neutral hedging sentiments (refer above diagram).

Well, these fundamentals, technicals, and skews suggest credit call spreads that are likely to favor both downswings in short run and major uptrend.

At spot reference: 18.049, one can deploy diagonal credit call spreads by writing 2m (1%) in the money call while initiating longs in 6m at the money call, the structure could be constructed at the net credit.

Source: In-house research and SG Cross Asset Research.

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.