A glimpse over Eurozone fundamentals: Euro area business and consumer surveys point to solid growth momentum in the region. Sentiment improved significantly during Q4’16 and remained robust in January, with the strong sector and country details. Consistent with this signal, Euro area GDP increased a solid 2% QoQ, SAAR in Q4’16 and was revised up for Q3 in the flash GDP report, published almost two weeks ago. Since then, the December plunge in German IP reported this week contradicted this positive message.

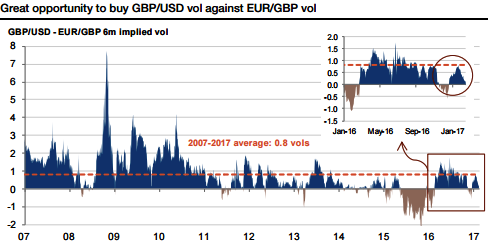

We encourage vol spread that seems very cheap for now; the 6m vol spread between GBPUSD and EURGBP volatilities is quasi-flat, whereas GBPUSD has been more expensive 82% of the time since 2007 (refer above graph). The realized vol of the spread from 2m to 1y is between 1.5 and 2.5 vols (refer above graph).

GBP idiosyncratic risk canceled out: The common risk is canceled out in the two legs, provided there is a consistent weighting. Given that both vols are very close, we obtain an almost vega-weighted trade in taking equal notionals. Domestically, UK parliament reconvenes after its February recess and the House of Lords will begin debating the government’s bill to enable the activation of the Article 50 process to leave the EU. The bill emerged unscathed through the House of Commons, and the Lords seem likely to make only modest tweaks.

EUR risk short-lived: The recent tightening of the spread is essentially due to the political risk premium in Europe, which is currently supporting EUR vols. Our central scenario sees Marine Le Pen failing to win the French presidential election and a euro bounce accompanied by a deflating of the EUR crosses volatility premium.

USD vol supported by US fiscal/monetary mix: Over the next months, US-Europe monetary divergence clearly supports a lasting volatility premium in USD crosses over EUR crosses, via more volatility in USD long rates and a Fed could become more hawkish than the market expects. This is the standard pattern seeing GBPUSD vol trading at a premium over EURGBP vol.

This week, upbeat headline US CPI and the announcement of the tax cut agenda at the end of the month could revive the market appetite for inflationary trades. This would support dollar volatility.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data