Indian industrial production rose at 7.5% for Jan, inflation softens to 4.4% for February:

India's industrial production expanded by 7.5% YoY in January 2018, following a 7.1% gain in the previous month and beating market expectations of 6.7%. Manufacturing output growth picked up to 8.7% in January from 8.5% in December, and electricity production rose 7.6%, faster than 4.4% in the previous month. Meanwhile, mining output grew by only 0.1%, compared with 1.2% in the previous period.

Consumer prices in India increased 4.44% YoY in February of 2018, below 5.07% in January and market expectations of 4.8%. It is the lowest inflation rate in four months but above the 4% medium-term target of the central bank.

From last December (Dec-2017), USDINR has turned out to be slightly bearish. Our end-year forecast remains for USDINR to push above the 65.00 level.

While bearish INR risk scenarios are listed as follows:

1) Crude oil price gains accelerate;

2) The fiscal position deteriorates;

3) Exports continue to underperform

Bullish INR risk scenario: FII limits for local bonds are raised.

We maintain a modestly higher trajectory in terms of our USDINR forecast profile on a combination of a wider current account deficit this year, risks around fiscal slippage and underwhelming Indian export performance.

Positive carry and the RBI’s more than adequate FX reserves should keep any periods of INR weakness bounded. As we progress towards the end of Q1 we also tend to see seasonal strength in the currency. Some retracement in commodity prices, particularly in terms of energy, has also provided some relief in terms of the extent to which the current account balance is likely to deteriorate.

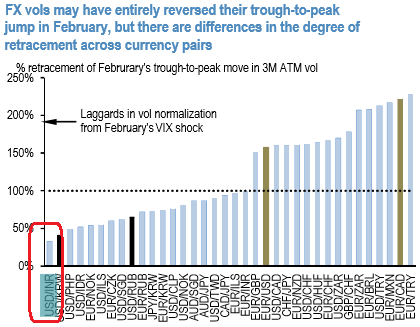

Trade tips: While low realized vol (least among the G20 FX universe, refer above chart) and technical support still indicates RKO put strategy, INR volatility stalls in the low vol bloc among the EM space (3m vol is trading below 6) but realized vol has remained constantly lower than implied vol since start 2016. The market is, therefore, pricing a premium not justified by the volatility of the FX rate.

This suggests selling volatility, and our USDINR bearish view combined with a strong technical support makes an RKO put attractive. While the skew oriented to the topside won’t provide an extra discount on the premium, such a positive skew indicates that market volatility should fall as the spot goes lower.

The rupee is strong on the back of custodial flows and upbeat GDP flashes. We continue to foresee USDINR to trade in a range of 63.25 - 65.953 in the months to come.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data