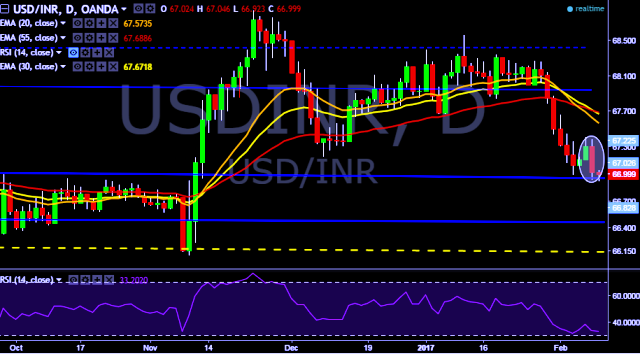

- USD/INR is currently trading around 66.99 marks.

- It made intraday high at 67.04 and low at 66.92 marks.

- Intraday bias remains bearish for the moment.

- Key resistances are seen at 67.31, 67.45, 67.66, 67.87, 67.99, 68.15, 68.32, 68.49, 68.63, 68.72, 68.85 and 69.52(August, 2013 high) marks respectively.

- On the other side, initial supports are seen at 66.92, 66.82, 66.68, 66.50, 66.28, 66.10, 65.95 and 65.81 marks respectively.

- In addition, India’s NSE Nifty was trading around 0.20 percent higher at 8,786.70 points and BSE Sensex was trading at 0.02 percent higher at 28,297 points.

- Yesterday RBI released interest rate decision.

- India’s repo rate stays flat at 6.25 % (forecast 6.00 %) vs previous 6.25 %.

- India’s reverse repo rate stays flat at 5.75 % (forecast 5.50 %) vs previous 5.75 %.

- India’s cash reserve ratio stays flat at 4 % (forecast 4.00 %) vs previous 4.00 %.

We prefer to take short position on USD/INR around 67.05, stop loss at 67.22 and target of 66.92/66.82.

FxWirePro: Indian rupee hits strongest level against U.S. dollar since November 2016

Thursday, February 9, 2017 8:37 AM UTC

Editor's Picks

- Market Data

Most Popular