Technical briefing:

The trend is likely to remain well within the range 139.4807 towards upside and 133.8596 on south as the price are fluctuating in line with 10 day moving average that looks like stagnant line. However, slight dips are expected in one month time frame.

We could foresee the Yen would gain in near term although upswings for the moment are rallying on this pair but any abrupt swings may turn adversely as we think the current uptrend is not that robust and long lasting, so we've tailored our formulation of strategies as the risk appetite varies from different investors to different traders.

Call Ratio Spread: EUR/JPY

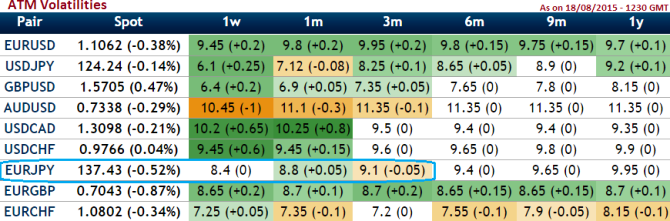

Rationale: With above range bounded trend being anticipated, more importantly, as you can see from the nutshell the pair is likely to perceive gradually picking up from1- months maturities, thus we recommend deploying call ratio spreads suitable for prevailing circumstances.

So, here goes the position this way, execute 2 for 1 near month (1.5%) Out of The Money calls/mid month (2.5%) In The Money call for marginal net debit.

Suppose in order to execute we buy EUR/JPY calls and short for net amount 100,000, then

Option Greeks of the long side call should be,

Delta = 0.53

Gamma = 0.02

Vega = 0.12

Theta = -0.15

Option Greeks of the short side call should be,

Delta = -0.84

Gamma = 0.04

Vega = 0.22

Theta = 0.28

The probable unlimited risk is only when EURJPY abruptly spikes above upper band (i.e. 139.4807).

FxWirePro: Improving odds on EUR/JPY call ratio- Option Greeks a run through when ATM vols marginally higher

Wednesday, August 19, 2015 6:14 AM UTC

Editor's Picks

- Market Data

Most Popular