AUDUSD contained in a 0.7600-0.7700 range. The pair in medium term perspectives seems to be at risk of testing 0.7600 during the next few days as USD longs are pared. However, in the longer term, we expect to see it slightly lower to back around 0.75. A steady hand from the Fed in June plus an optimistic RBA should limit downside on AUDUSD during the next few months.

Further out, though, the underlying AUD trend should be gently lower, as growing bulk commodity supply gradually cools the 2016 price surge. Iron ore should be back under $80/tonne by June, with further (modest) declines likely in H2 2017.

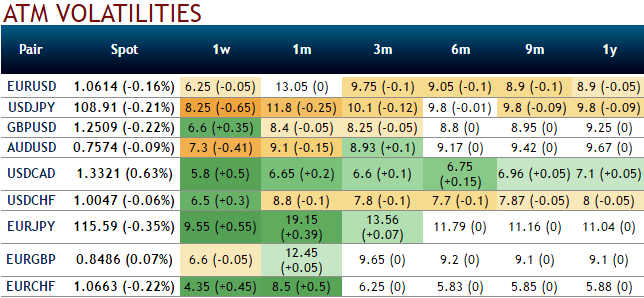

Let’s also glance on sensitivity tool for 1-3m IV skews would signify the interests of OTM put strikes that would imply hedging sentiments are for downside risks in the underlying spot FX as Fed is most likely to hike rates.

OTC hedging arrangements for downside risks seems intact, you could make this out from the above nutshell evidencing risk reversals, while IVs are spiking higher (for 3m tenors) which is in tandem with the above mentioned underlying forecasts and its rationale.

Please be informed that the nutshell showing negative risk reversals are bids for the hedging for the downside risks, as a result, puts are on more demands over calls. The negative risk reversals across all tenors are indicating the bearish hedging interests.

Please be noted that the 1w ATM puts are overpriced than prevailing implied volatility. 1w ATM puts priced 30% more than NPV, whereas 1w IVs are shrinking below 7.5%. Hence, amid bearish-neutral risk reversals with this considerable disparity between IVs and option pricing we see an ideal shorting opportunity for option writers in overpriced OTM puts.

Option Trade Recommendation:

Weighing up above aspects, we eye on loading up with fresh longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 1w (1%) OTM put option as the underlying spot likely to spike mildly, simultaneously, go long in 1 lot of long in 1m ATM -0.49 delta put options and 1 lot of (1%) ITM -0.55 delta put of 2m expiry.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary