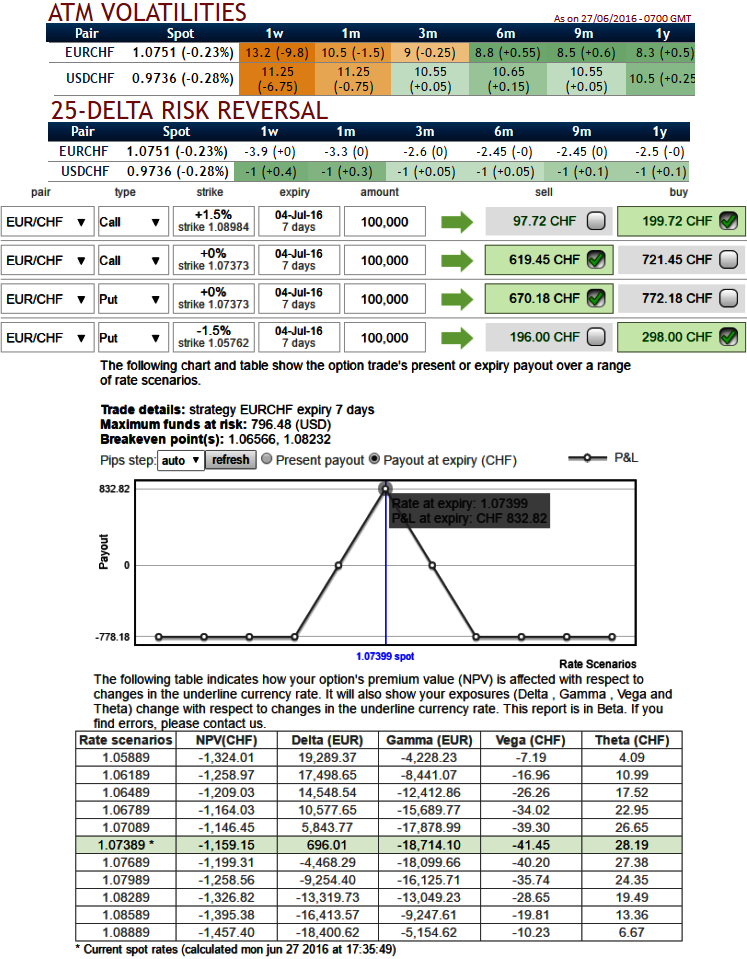

We spot out the massive drops in 1w-3m IVs, 13.2% in 1w expiries and 9% in 3m tenors, while risk reversals favor bulls in Swiss franc for which SNB is unhappy with.

Since the minimum exchange rate in EURCHF was abolished interventions have become part of the SNB’s everyday repertoire.

The way we like to yield the advantage by trading implied volatility is through iron condors.

With this trade, you are selling an OTM Call and an OTM Put and buying a Call further out on the upside and buying a put further out on the downside.

Let’s look at the instance shown in the diagram and ponder over where we place the following trades today gauging IV shifts.

To execute an iron butterfly, as shown in the diagram the options trader can initiate a lower strike OTM put, sells a middle strike an ATM put, sells a middle strike at-the-money call and buys another higher strike OTM call, this results in a net credit to put on the trade.

The iron butterfly spread is a limited risk, limited profit trading strategy that is structured for a larger probability of earning a smaller limited profit when the underlying spot FX is perceived to have a low volatility.

The sensitivity tool also consists of the payoff diagram for the trade mentioned above straight after it was placed. Notice how we are short vega of 41.45. This would imply that the net position will benefit from a fall in implied vols.

Please be noted that the tenors, strikes, and instruments shown in the diagram are just for demonstration purpose only, use appropriate inputs as suitable to your trading profile.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge