Since we’ve advocated the 3-way straddle versus put on gold’s hedging, this is just to follow up to our previous write up.

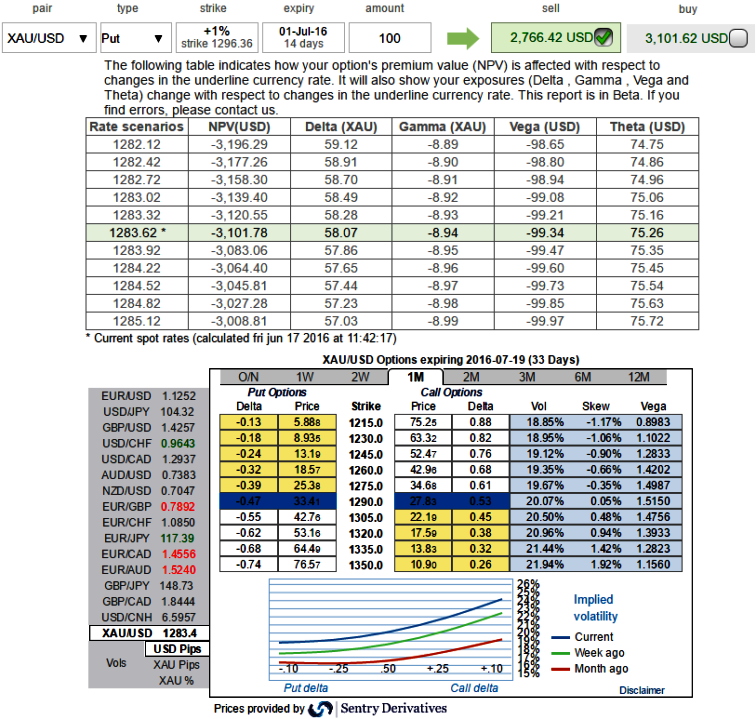

The implied volatility of 1W XAU/USD ATM contracts 17% but 23.52% and a tad above 20% for 2w and 1M tenors respectively, cheers..! Good news for writers.

The skew appears considerable for long side compared to the volatility, strongly suggesting spread with OTM strikes-like structures, conducive for writers.

Please be informed that the highest theta numbers on ITM put strikes, thereby, the writer of option most unlikely to be obligated for option exercise if underlying spot gold keeps spiking on expiry.

For ITM and OTM options as the time to expiry draws nearer, Theta lowers and decreases. The above sensitivity table is an instance as to how Theta responds when the option is ITM, ATM, and OTM, and as time passes. You can also observe the dramatic impact of time decay (Theta) for an ATM option approaching expiry.

Theta of USD75.26 on ATM strikes would mean that as underlying spot gold travels through OTM or even remain stagnantly then the premium received would keep on shrinking (in other words the option value would deteriorate) contemplating time decay factor.

The execution was this way,

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Eying on favorable theta shifts considering lower skew and shorting expensive calls with shorter expiries. As a result, we capitalize on beneficial instruments to reduce hedging cost.

Go long in XAU/USD 2M At the money delta put, Go long 4M at the money delta call and simultaneously, Short 2W (1%) out of the money put with positive theta.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close