Since Donald Trump was elected as the next President of the United States in November, the Japanese yen has lost more than 11 percent of its value against the dollar and that has led to the reversal in Japanese benchmark stock index Nikkei 225, which had previously suffered the might of the yen has declined from 20900 in August 2015 to 14850 in June 2016; a decline of 29 percent within a span of 12 months.

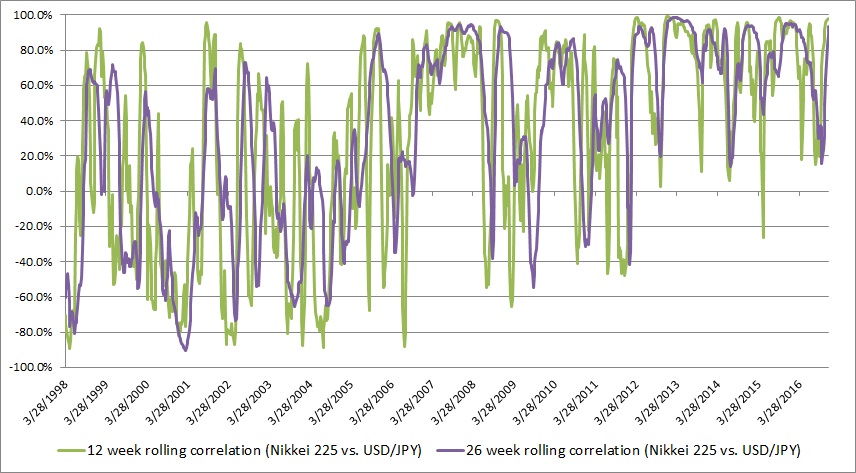

In recent monetary policy, the Bank of Japan (BoJ) now sees a better growth prospect in Japan. The Nikkei 225, which is currently at 19450, is likely to rise further as we expect the yen to weaken a bit more against the dollar. Historically, Nikkei and the yen have shown cozy relations, as yen declines Nikkei rises, since Japan is an export driven economy. The average of 26-week rolling correlation between Nikkei and USD/JPY exchange rate dating back to 1998 is about 33 percent and the relation has been cozier in recent days. The 26-week rolling correlation is currently at 93 percent and 12-week rolling correlation is at 98 percent.

We expect the Nikkei to strengthen to at least 20500 and possibly test the 21000 level over the coming months.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed