EM FX looks like it has appreciated more than EUR recently which may give some headwind to the extent of EM moves, if the EUR does not recover further.

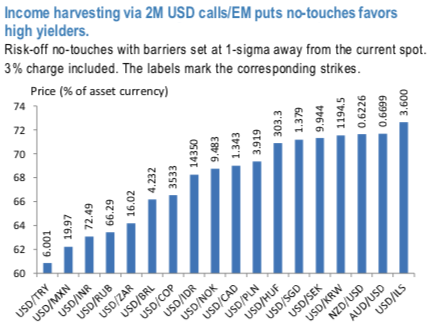

A passive play on a cautiously EM supportive sentiment is to own short-dated USD/EM call no-touches (NTs). These take advantage of elevated levels of spot, forward/NDF points, vols and skews and can be viewed as defined downside alternatives to selling naked vanilla EM puts. 1st chart ranks 2M high beta structures with barriers set to 1-sigma away from spot (arbitrary condition but sets pricing of different pairs on same footing). Vol selling is a poor leverage.

Likewise, 2nd chart shortlisted 2M structures offer 1:1.5 risk/reward ratio, with sensible barrier selection at 1-sigma away from current spot (here, 1-sigma = std.dev. of 2m spot returns over the past 12-months).

To avoid the year-end holiday effect on pricing consider in 3M expiry: 3M USDMXN call no-touch with barrier at 19.90, the level last seen 2m ago, costs 50.0/52.75%, indic, (spot reference: 19.19).

3M USDRUB call no-touch with barrier at 66.0, costs 51/56%, indic, spot reference: 63.80 levels. Courtesy: JPM

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields