As per NASDAQ, China's yuan softened against the U.S. dollar on Friday and is set for its worst week in more than three months, dampened by weaker guidance and rising corporate demand for the greenback.

In late May, the Chinese authorities let the yuan appreciate by more than 1 percent, a sizable leap for a currency that normally trades within a wafer-thin range and shed 6.5 percent to the dollar last year.

RMB Currency Futures traded at Hong Kong Exchanges and Clearing Limited (HKEx) is scheduled for enhancements to upgrade their accessibility and functionality, as well as providing greater over-the-counter flexibility, according to a bourse announcement.

The HKEX recently publicized few signs of progress to its Renminbi Currency Futures that covers USDCNH, EURCNH, JPYCNH, AUDCNH and CNHUSD futures.

RMB futures were announced to meet growing demand in the region for risk mitigation and cross-currency hedging tools. The move was also aimed at expanding the Hong Kong bourse futures market as the country has signaled its ambition to become an offshore yuan trading center.

The first batch of changes concerns trading hours of RMB Currency Futures with HKEX extending the day and after-hours trading by half an hour and an hour and a quarter respectively, effective July 10, 2017.

Why is Renminbi hedging important: Those who’re dealing with China who has Renminbi exposures, more than just a price comparison, currency hedging is quite essential. At the same time, the question arises which of the hedging options available is the most advantageous.

Renminbi hedging vibrant: It became clear in late 2014 - if not before - that hedging against CNY exchange rate risks is indispensable. While until late 2014 the Renminbi was under constant appreciation pressure CNY weakness then became the main issue until early 2017.

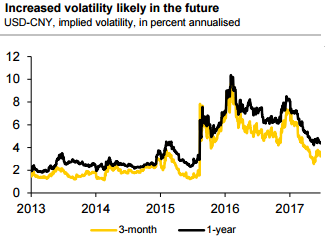

Over the past few weeks, CNY was able to appreciate notably again. All that has been reflected in a notable rise in volatility since 2014 (refer above chart). The economic difficulties in China but also the surprising institutional changes (e.g. to the fixing process) suggest that higher CNY volatility is likely to be the norm in the future.

Economize on premium-spend on carry trades using ratio call spreads that generate comparable returns to standard ATMF/ATMS option spreads but with lower premium outlay. USD put/Asia FX call ratios are well priced currently, with USDCNH the favored pick.

Alternatively, in our upcoming write-up, we compare a hedging via CNY-NDFs and hedging with the help of CNH forwards, both for importers and exporters.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand