For now, we all know that the dollar getting some traction, in response to Janet Yellen’s hawkish rhetoric while delivering speech at the NABE annual conference. It’s was up by no more than 0.5% against any currency. The Fed played out to the hawkish end of our scenarios, and no doubt, the USD has repriced appropriately in the recent past. But further pricing in of the 2018 dots and cyclical outperformance will require time and rely on inflation.

We are stating this because one should understand that the yellow metal price will have subtle reactions to both U.S. rates and the dollar. A softer dollar makes this precious metal cheaper, whereas a rise in U.S. rates lifts the opportunity cost of holding non-yielding assets such as bullion.

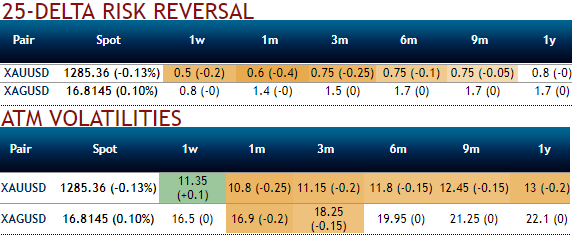

To price-in, these fundaments driving forces, the OTC bullion markets’ functionalities have been intensified. Please be noted that the implied volatility of 1w is picking up, while the same is fading for across all long-term tenors of XAUUSD ATM contracts, but then well above 11%, (for 3m-1y tenors), while the positively skewed IVs 3m tenors signify the hedging sentiment has been well balanced for both bullish and bearish risks ahead of Fed’s funds decision in December season.

While, risk reversals with negative shift indicates short bearish risks, while for the lengthier tenors continue to signal upside risks, short-term RRs indicate risk sentiments have turned onto bearish targets.

Considering fundamental developments in bullion markets we had figured out an opportunity in writing an expensive OTM call while formulating 3-Way Options straddle versus OTM calls strategy.

By looking at the slumps in the gold prices, one can make out the advantage of writing such options (pocket the initial premiums received as the previously advised shorts of OTMs of 2w expiries goes worthless), while long leg of ATM puts are arresting downside risks.

We would now like to add an extra-long-leg in ATM delta puts to the existing strategy as shown in the diagram.

Spread ratio: (Long - 2:1)

Rationale: Bidding 1m risk reversals match the 3m IV skews.

As stated above bullion market sentiments remain safe-haven demand in long run especially after the delayed FOMC hikes (Fed may not have risen in this meeting) but quite possibly one in December meeting and 2-3 hikes in 2018.

Sentiment on the U.S. dollar also remained supported since Fed Chair Janet Yellen called for gradual rate hikes in a speech in the recent past.

We reiterate the negative risk reversals indicate mounting hedging sentiments for the bearish risks in 1 week, while fairly balanced IV skews that keeps us eye on shorting expensive calls with shorter expiries. As a result, we capitalize on such beneficial instruments and deploy in our strategy.

The execution:

Go long in 2 lots of XAUUSD 3M At the money -0.49 delta put,

Go long in 1 lot of 2M at the money +0.51 delta call. The strategy is constructed at net delta of -0.40.

As shown in the diagram, the strategy is likely to derive positive cash flows regardless of the swings with more potential on downside moves.

Currency Strength Index: FxWirePro's hourly USD spot index is flashing 34 (which is mildly bullish), at 07:18 GMT. The softer dollar is also conducive for the above strategy advocated. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential