In our view, the medium-term prospects for Brexit and by extension GBP remain in a state of uncertain political flux. Investors may have assumed that a transition was a done deal but there are substantive aspects of the transition (the Irish border, migration) on which the UK and EU have not been able to agree (because they are so politically charged for a fragile Conservative government) and which prompted the EU’s chief negotiator to warn last week that a transition was not a given. A non-negotiated cliff-edge Brexit may be a very low probability event but that probability is not zero. Beyond the transition, the UK government continues to obfuscate about its longer-term objectives for Brexit as PM May is unwilling to break the uneasy truce which exists between the hard and soft Brexit factions within her party.

Until it becomes clearer in which direction the political tide within the Conservative party is flowing, we are reluctant to project a collapse in the Brexit risk premium. This risk premium is currently around 14% have been as wide as 19% and as tight at 11% in the wake of the referendum (we measure the premium as the difference between the GBP REER and its 20Y average).

Hedging strategy:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

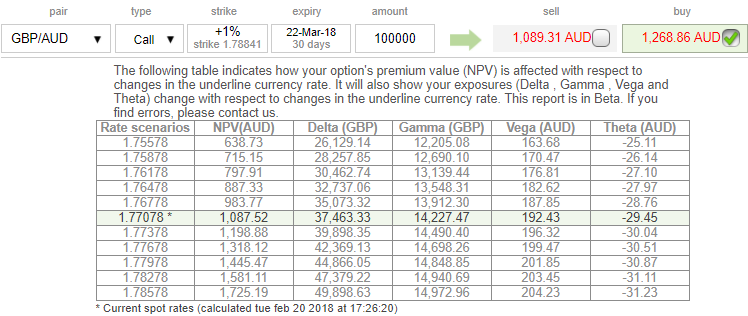

The execution: Initiate long in GBPAUD 3M at the money -0.49 delta put, long 2M at the money +0.51 delta call and simultaneously, short theta in 1m (1%) out of the money call with positive theta or closer to zero.Theta is positive; time decay is bad for a buyer, but good for an option writer.

Rationale: The underlying spot FX has been oscillating on either side.

Please be noted that 3m skews are also stretched on either side, which means ATM options have more likelihood to expire in the money and the 1m IVs are just shy above 9.2%, whereas 1% OTM calls of this tenor seem to have been overpriced at 16.75% more than NPV, hence, we foresee writing such exorbitant calls amid bearish pressures are beneficial as there exists the disparity between IVs and option pricing.

Hence, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

Currency Strength Index: FxWirePro's hourly GBP spot index has turned into -6 (which is neutral), while hourly AUD spot index was at shy above -21 (bearish) while articulating (at 11:50 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise