We are a little surprised at how well risk markets and EM currencies have traded despite a slew of trade protectionist-leaning appointments to the Trump cabinet over the past few weeks. As noted in our 2017 FX Outlook, we expect the trade issue to prominently feature in the US policy agenda before long, and Mexico stands in the direct line of fire of the conflict as evinced by this week’s sharp reaction in MXN spot and vols following anti-trade tweets from the President Elect.

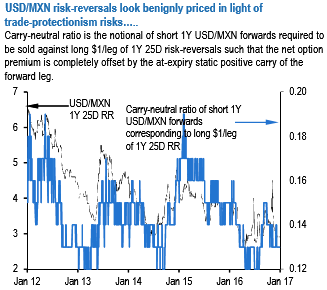

Our Latin America strategists note that Banxico has severely limited reserve firepower to counter a potential regime change in US external policy, and that a renegotiation of NAFTA could push USD/MXN levels even upto as high as 25. Yet USD/MXN risk-reversals look decidedly benign in the light of these risks–1Y skews are back to pre-election levels and near 5-yr tights –and like CNH, particularly in comparison to elevated MXN implied yields that top 7% in 1-yr and out expiries (see above chart).

One possibility is that depressed riskies are an artifact of USD call/MXN put selling flows from real money yield harvesting programs, but we doubt those will be able to impose a cap on option markets in the event of a shock, and investor positioning in MXN based on JPM client surveys does not appear heavily short in a way that can mute realized vol and realized spot-vol correlations in a sell-off.

Along the lines of CNH therefore, partially delta-hedged USDMXN risk-reversals (carry-neutral ratio 0.13) strike us as a more efficient way of carrying short MXN risk than forward outrights. While not as exposed to Mexico trade tensions, USDZAR is another EM currency where risk reversals do not discount much likelihood of EM stress, and a target for establishing short risk positions in anticipation of trade-conflict spilling over onto the broader EM complex.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025