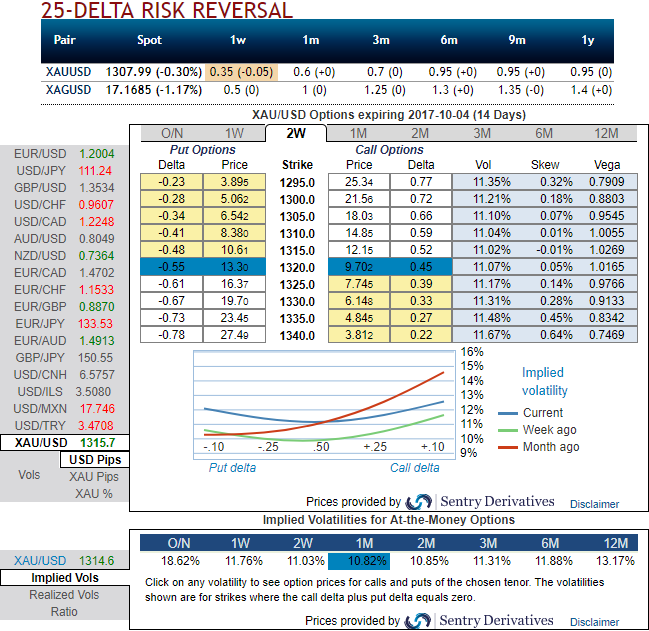

The implied volatility of 1m XAUUSD ATM contracts is a tad below 11%, (10.82% to be precise), while the skews in these IVs signify the hedging sentiment through OTC market has been well balanced for both bullish and bearish risks ahead of Fed’s funds decision.

While, bullish neutral risk reversals of lengthier tenors continue signalling upside risks, whereas 1w RRs indicate risk sentiments have turned onto bearish targets. Considering fundamental developments in bullion markets we think the opportunity lies in writing an expensive OTM call while formulating below strategy for gold's fluctuation at this juncture.

3-Way Options straddle versus calls

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Bidding 1m risk reversals match the IV skews.

As stated above bullion market sentiments remain safe-haven demand in long run especially after the delayed FOMC hikes (Fed unlikely to raise in this meeting) but quite possible 3 hikes in 2018.

We reiterate the negative risk reversals indicate mounting hedging sentiments for the bearish risks in 1 week, while fairly balanced IV skews that keeps us eye on shorting expensive calls with shorter expiries. As a result, we capitalize on such beneficial instruments and deploy in our strategy.

How to execute:

Go long in XAUUSD 1M At the money -0.49 delta put,

Go long 1M at the money +0.51 delta call and,

Simultaneously, Short 2w (1%) out of the money put with positive theta.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data